An evening with Mr. Chandu Nair

On Friday, August 13, we had an engaging session by Mr. Chandu Nair, a serial entrepreneur. Mr Nair’s mission in life is to help entrepreneurs to succeed. He plays three roles: Mentor/angel investor in the early stages of the lifecycle, Growth advisor in the next stage and an investment banker who can facilitate the sale of the company in the later stage of the life cycle.

About Mr Chandu Nair

Mr. Nair is an alumnus of IIM Ahmedabad. He has three decades of rich experience in industry, consultancy, media and information services. Previously, he was the CEO of Scope eKnowledge Centre, a KPO company which he successfully exited. He has also worked in Asian Paints in sales and in Businessworld as a journalist.

Mr. Nair is on the advisory board of Fulcrum, a Private Equity firm. He is also on the board of Menterra, a social impact fund and Shankara Build Pro, a retail building products company. Mr Nair is associated with the investment bank, Chesapaeake. He advises incubators in IIM Kozhikode and Crescent.

Introduction

Mr. Nair started off with an inspiring message backed by a striking visual: We must leap over failures to achieve success.

Failure is the default mode. More ideas and products fail than succeed. Some 90% of new businesses fail. 75% of venture backed start-ups fail in the US. As Mr Nair added in the Q&A, even among large family businesses, the failure rate is high. Only 13% of businesses cross the second generation (They are born with the silver spoon.) and only 4% outlive the third generation (They have to deal with the mess created by the second generation). That is why we have the saying shirt sleeves to shirt sleeves in three generations. The hard work of the first generation is undone by subsequent generations.

The key to success is not chance or luck. It is really being there every day and fighting it out.

To succeed, passion and gut instinct alone are not enough. Many entrepreneurs attribute their failure to lack of money. But that is only part of the story. The real issue is often lack of planning. As the saying goes, if we fail to plan, we are planning to fail.

Mr. Nair likes to define a start up in a simple way: It is a temporary organization that is looking for a scalable and repeatable business model. The plan can never be clear on Day One. Any start-up will have many options along the way. The key to success is knowing which options to exercise along the way.

Lifecycle of a venture

A venture goes through different stages. In each stage the challenges and the decisions to be taken are different.

Ideation: It all starts with an idea. The first hard decision is: Do we want to be in the business?

Understanding the contours of the business: Is the idea feasible? Can we get it validated by others- friends, family, customer, etc?

Crossing the valley of death: For the first 18-24 months, new ventures must cross the valley of death. Many ventures do not cross the valley. If success is unlikely, the objective should be to fail fast and fail cheap.

Scaling up and a possible exit or IPO.

At each stage, we must be taking quick decisions with respect to product channel, pricing, etc. Only 30-40% of the decisions turn out to be right. Yet, we must move fast. Paralysis by analysis must be avoided. We must take decisions and work to make them right.

Dealing with unknowns

Any venture faces a whole list of unknowns with respect to technology, market, finance, team, etc. There is no formula for success. Yet the entrepreneur must try to minimise uncertainty and risk to the extent possible.

Converting No to Yes

The entrepreneur will keep hearing the word “No” frequently. The job of an entrepreneur is to convert a no to yes. The more entrepreneurs can make people say yes to them, the more likely they will succeed. They must turn unfavourable situations into favourable ones.

Key reasons for failure

Cash flow problems: This is one of the most common causes of failure. Cash flow is like blood flowing in our body.

There is no market need for the product.

There is no uniqueness or differentiation for the product /service offering.

Team/Execution problems: There could be conflicts among the founders. Talent attrition can also be a problem.

Timing: Sometimes, timing can be a problem. This also means pivoting. We must pivot to new ideas when necessary.

Mr Nair gave his own example. He was running a traditional bespoke industrial marketing research company. During the dotcom boom, he moved into an adjacency: online content and information services. During 1998-2002, the company did well. When there was a dotcom bust, seeing the rise of IT services and BPO he moved into Knowledge Process Outsourcing for overseas companies. His company built capabilities in marketing to overseas clients and scaled up rapidly from 60 to 1100. The lesson is that we must learn to leverage our existing competencies to move into adjacencies. At the same time, we may have to build one or two new competencies if needed.

Mr Nair made a point that the value of information is appreciated more overseas than India. We know that Alexander invaded India in 326 BC only because the Greeks documented it! Data and information are much more valued in the west and they are prepared to pay for it. As Mr Nair joked, we propitiate Goddess Saraswati in India and find Goddess Lakshmi in the west!

Typical issues and approaches

Product market related

Clones of foreign ideas usually do not work in India. Kellogg’s is a good example. The company tried to sell cornflakes and found that breakfast with a spicy taste is preferred to a sweet taste in India. Moreover, people preferred hot milk to cold milk when consuming cornflakes. Now after more than 20 years, Kellogg is launching Upma and Poha.

We need a unique sustainable differentiator to stay relevant.

We must always look at things from the customer’s point of view and try to stay relevant.

We must not decide based on assumptions. Instead, we must try to validate these assumptions. We can use structured methods such as the 5 why approach to understand methodically what is going on. Today, we have the technology that makes it easy to iterate and make MVPs. (Compare overhead projectors and cyclostyling with PPTs and desktop publishing.) We must go out into the field and be in touch with reality.

We must not be over possessive about our idea. We must keep our ego outside the door. We must pivot and do whatever makes sense in that context.

We must not get discouraged by failure. As Thomas Alva Edison once remarked:” I have not failed. I have just found 10,000 ways that do not work.” We must pick ourselves up when we fall and try again. That is the key to success.

We should try out more options and double our failure rate.

Take the example of the famous 3M post it note. It looked like a defective product: something which was not sticking very well. It took some time for 3M to find out where it could be used. Thus, the success was accidental.

Cofounders/core team

It is important to have alignment of core values.

We must trust but verify. We must check the credentials of the cofounders and key employees.

Nothing like the cofounders having worked together earlier. In Israel, often the founders would have worked together in the army.

It is good to have a written MOU and a cofounder agreement.

There must be communication mechanisms both formal and informal. Conflict resolution mechanisms are also important. The roles and responsibilities (who will speak to the media, etc), titles, etc must be defined clearly.

As Rockefeller once mentioned: “A friendship founded on business is a good deal better than a business founded on friendship.”

Business failure and entrepreneur attitude

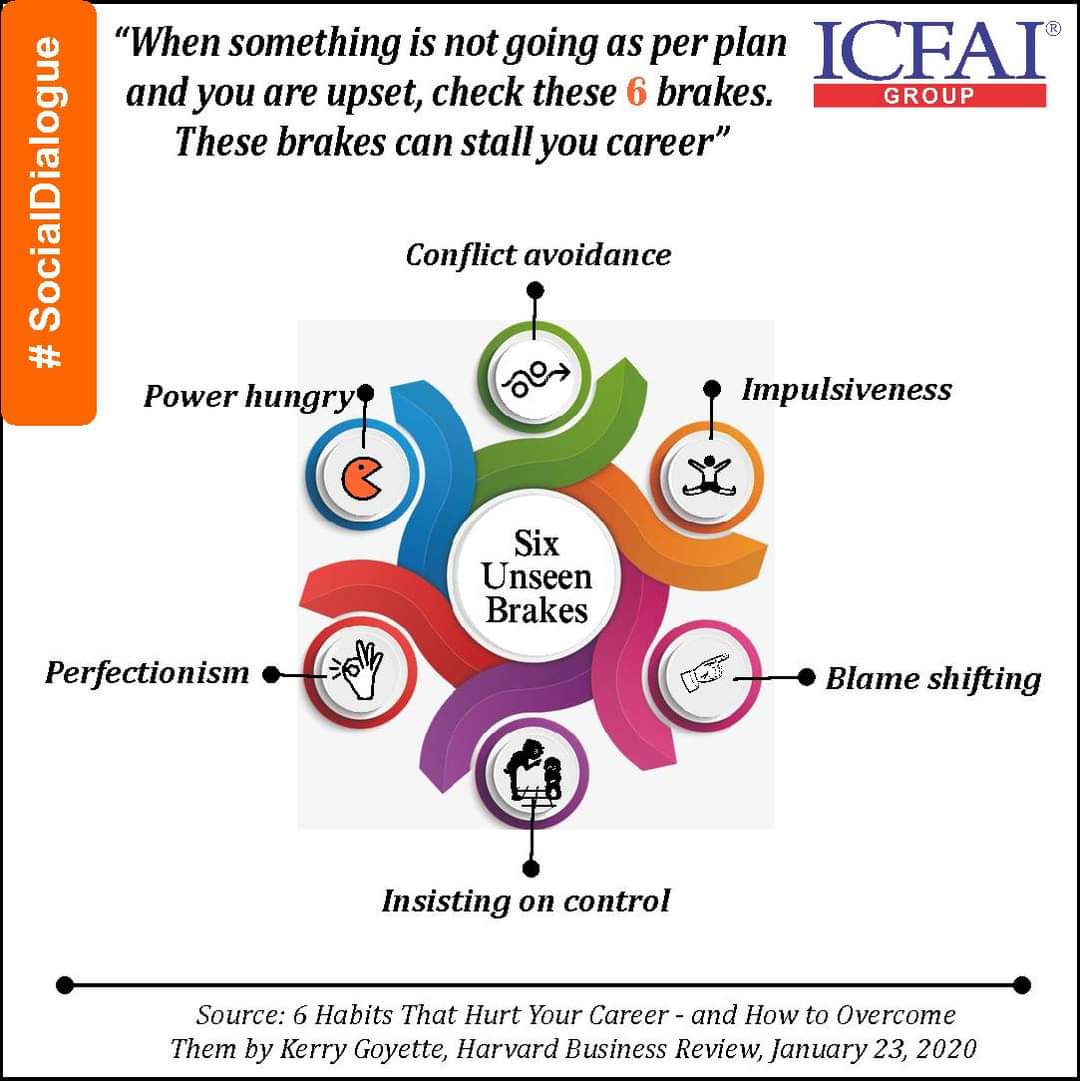

When we have a failure, we can blame the external situation/ others or introspect on what went wrong. Some people try to avoid criticism by withdrawing completely. But as Napoleon mentioned, if we do nothing, we will end up as a nobody.

The attitude should be: The business failed but I did not. Failure should be treated as a stepping stone to success. Often failures teach us more than successes. Failure is success in progress. Failures are necessary to change ourselves to build a better business.

As Jeff Bezos has mentioned, the attitude should be: “I know if I failed, I wouldn’t regret. But the one thing I might regret is not trying.”

During the Q&A, Mr Nair added that we must believe in ourselves even if we fail. It is important to keep the family aligned with us. The support of mentors and cofounders is also important. We should also not hesitate to take professional help if required. We must conserve our resources, recoup our energy and start again.

Despite the high probability of failure, entrepreneurship is worth a try. As Mr Nair put it, entrepreneurship is living a few years of your life like most people won’t (working hard with intense focus) so that you can spend the rest of your life like most people can’t. It is all about giving up a few years of our life to enjoy the remainder of our life.

Concluding remarks

A start up’s business model is nothing but a set of hypotheses. It involves a set of assumptions that the entrepreneur must keep validating.

Entrepreneurs must find their place by pivoting when required. They must make the cycle virtuous by taking good decisions

Mr Nair concluded: “I have learned so much from my mistakes that I am thinking of making a few more.”

Q&A

The start-up ecosystem in India

The Indian start up ecosystem has come a long way in the last few years. It supports start-ups at various levels: prototype, commercialisation, scaling up, etc. THub/TiE, Hyderabad and other such organizations serve as “watering holes” (places to network) for entrepreneurs. IIT Madras,, another watering hole, has five incubation centres. There are senor entrepreneurs here who can act as mentors. There are structured programs as well. E cells in colleges, Wadhwani Foundation, Udayam, TiE Chennai. There is even an entrepreneurship curriculum developed for schools by Udhayam and TiE. There are competitions. There are TiE youth entrepreneurship awards.

There is a lot of free money and grants available today. Among the companies which provide accelerators are Microsoft ($200,000-250,000), Google, Jio Next (170 start-ups).

There are various technology business incubators under DST. Atal Tinkering Labs have been set up in schools. Central and state governments have various schemes for early-stage funding. There are innovation voucher programs for patenting in India and overseas.

In short, there is a lot of support from government, corporates, academic institutions and non-government bodies. For example, the Tatas have acquired several start-ups.)

We must tap into the resources available. However, we must choose the right incubator to improve the chances of funding. Many incubators, especially in colleges, are non-functional. We must visit the incubator and find out what kind of companies are operating in the incubator and talk to some of the entrepreneurs. Once we go to the watering hole and start networking, things start falling in place. Association with an incubator increases the chances of funding and getting the support of mentors and corporates. Accelerators come later.

Grants, start-up seed funds, competitions, friends/family, angel investors, micro VCs, crowdfunding platforms, VCs, PE funds, revenue based financing (applicable for D2C companies), can all be tapped for funding at different stages of the life cycle. We must start building the network well before we need the funding.

Deep tech /Medtech ventures take time. The grant route is preferable. There are DST and other seed funds available.

Gaps in the ecosystem

There are some gaps also to be addressed in our ecosystem. About 87% of the funding goes to entrepreneurs based in Bangalore, Mumbai and NCR. Hyderabad, Chennai, Pune, Chandigarh, Jaipur and Calcutta make up most of the remaining funding. Women receive a very small percentage of the funding. Graduates of Ivy league institutions (IITs, IIMs) get most of the funds. A lot of the money, especially at the growth stage is coming from foreign investors.

Critical aspects of a venture

The two key aspects are: Idea (Product market fit) and the Individual (the ability to evolve). If these are sorted out, most problems can be addressed.

We must evaluate the idea and validate it. Early validation of market acceptance is important.

At each stage of the life cycle, different skills are required, and we must evolve as individuals. Either we must develop them, or we must bring on board people with complementary skills.

Deciding where to invest

Great teams can make a success out of an average idea. An average team can bungle a great idea. So we must bet on the team rather than the idea.

Bulk of the funding goes to people with 12-15 years of experience. They have already made mistakes using other people’s money. They have a network, can find cofounders more easily and have a better understanding of the marketplace. They have gone through the ropes and do not need to be spoon-fed. They will work hard and are more likely to pivot if required.

The first part of a due diligence exercise is “chemistry”. Do we feel comfortable engaging with the person? Is the person a good listener and willing to take inputs from others and keep adapting? Then comes the “physics”. We must start interacting with the entrepreneur. Finally comes the “maths”, the valuation, remuneration, stake to be taken, etc. The operating principle is: trust but verify.

Growth orientation and Level of control are two important dimensions to be considered. There are people who have entered a business voluntarily or out of compulsion. Among these, there are some with a low growth orientation and others with high growth aspirations. Maximisers are people who have voluntarily entered the business with a high growth orientation. They are the key focus for investors.

How do we know when a venture is failing?

The key metrics to be tracked would vary with the stage of the life cycle. In general, we should use leading (forward looking) indicators rather than lagging (backward looking) indicators.

In most cases, the most important dimension to track is customer acceptance. How many visitors is the website attracting? How many daily visitors are coming to the site? How many visitors are coming to the site per day? What is the time spent by an average user on a single visit?

In some cases, talent attrition could be the metric to track.

Mr Nair also gave an example of concentration risk. One start up depended on a single customer for the bulk of its revenues. When the customer took the work inhouse, the start-up ran into serious problems.

On BSchool incubators

Mr Nair felt that in a B School, the current students may not be the target audience. It is better to target alumni with about 7-8 years of experience who want to work with their alma mater. We can also target entrepreneurs in the vicinity of the B School. To succeed, the institution should have some core capabilities. IIT Madras for instance has capabilities in electric mobility. B schools can also target advisors and customers through virtual incubators.

On how acquisition targets are identified by investment banks

Investment banks usually work based on investment hypotheses.

Mr Nair gave two examples:

Hypothesis 1: Consider software as a service. India is not a great market for software. But it is a good place for frugal engineering. Software can be developed in India for a global market. With an effective sales engine, the software can be sold abroad.

Hypothesis 2: India has a huge domestic market. A range of India specific products can be sold online. Many D2C brands have succeeded.

On how BSchools can teach entrepreneurship

AICTE offers an MBA in Innovation, Entrepreneurship and Venture Development. Students should be encouraged to develop their idea in Semester 1. Then they can start doing projects (and also their Summer Internship) around the same idea through the course. Instead of professors evaluating the student presentations, outside experts and potential customers can be invited.

The classic MBA program is designed to produce managers and encourages the mindset of preservers and not creative destroyers or creators. So, the program needs to be tweaked.

Instead of meeting companies and requesting them for SIPs in the traditional way, B Schools could move to an outcome based model. B Schools should work with companies on the problems they have and be paid based on the outcomes delivered. For example, B Schools can request customer data through an API and process the data using analytics to deliver valuable insights to the company. B Schools must change the approach from: “Give us some projects” to “What problem can we solve for you?”