An evening with Mr. Mohan Guruswamy

On Friday, November 19, we had a fascinating session by Mr Mohan Guruswamy, a well-known author, commentator and activist. Mr. Guruswamy spoke about how the world economy has evolved in the last 2000 years and how it will evolve in the years to come. He spoke about the opportunities India has and what the country must do to capitalize on them.

About Mr Guruswamy

Mr Guruswamy has studied in prestigious institutions like Nizam College, John F Kennedy School at Harvard and Graduate School of Business at Stanford. He has played several roles in his illustrious career: Teaching, Journalism, Senior Management, Advisor to the finance minister. He is the author of several books and writes a very popular newspaper column. His articles have also been published in reputed journals like Economic and Political Weekly.

The global economy

Mr. Guruswamy began by stating that there is no crisis as such in the

world economy. But it is a system with a weak foundation. That is why

we see upheavals from time to time. We saw how the global economy

could be affected after the Asian contagion in 1998 and the collapse of

Lehman in 2008.

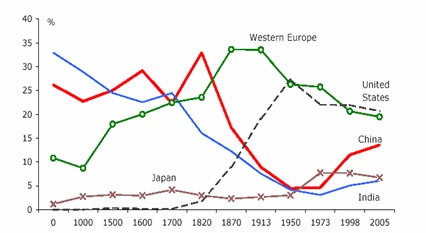

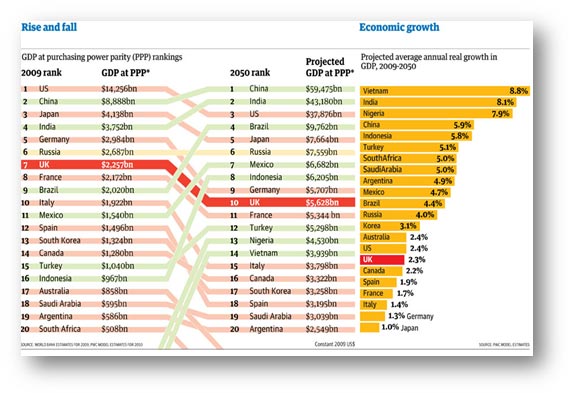

About 2000 years back, India was the largest economy in the world accounting for about one third of the global GDP. Till the time of Mughal emperor, Aurangazeb we retained this status. Thereafter, our decline began. Our share slid to 4.7% in 1950. Since then, it has improved. The current outlook for the Indian economy is quite good. If we grow at current rates, we can catch up with China by 2050. But we cannot take this for granted and have a lot of hard work to do.

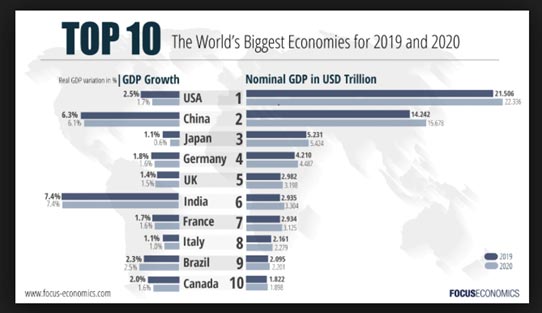

The global economy has come a long way since 1900. The world GDP

was just $1.1 trillion in 1900 and took half a century to grow fourfold to

$4.01 trillion. It then grew tenfold to $41 trillion by 1990. The world GDP

is now about $84 trillion and growing at 3.6%. During the past eight

years the global GDP has grown at about 4% a year. The US, China and

Japan are today the three biggest economies in the world.

The big leaps in global GDP began after 1971 when US President Richard Nixon unilaterally delinked the US dollar from the international gold standard (also called Bretton Woods) under the Smithsonian agreement. The move came after the famous oil shocks of the 1970s led to stagflation in the economy. The Arabs raised the price of oil sharply and left countries scrambling to find the money to purchase this vital commodity.

The Arab moves to dictate terms in the oil market followed the Yon Kippur war launched by Israel. Arab members of the Organization of Petroleum Exporting Countries (OPEC) imposed an embargo against the US in retaliation for the U.S. decision to support Israel.

Global trade

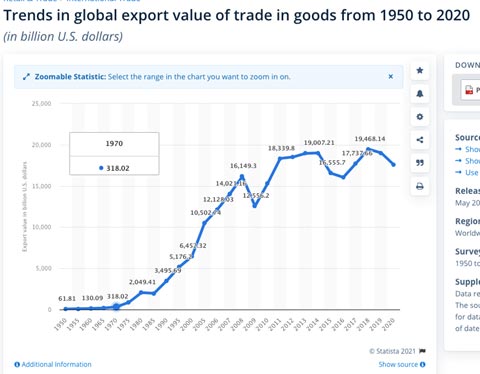

Currently, world exports are about $ 20.5 trillion while imports are about

$ 18.5 trillion. The total world trade is about $39 trillion and growing at

2.6%. China (including Hong Kong) is the biggest player with $5.31

trillion. The EU’s share is $4.49 trillion and that of USA is $3.91 trillion.

The top five trading nations (USA, China, Germany, Japan and EU)

account for $19.11 trillion or 50.6% of global trade.

The picture in 2050

By 2050, the picture will be quite different. China and India will be the

two largest economies in the world. As their economic power increases,

their political power will also increase. The USSR could sustain the cold

war against the US even though it was a much smaller economy. But

today, economic power is the basis for political power. That is why China

commands so much respect from western nations.

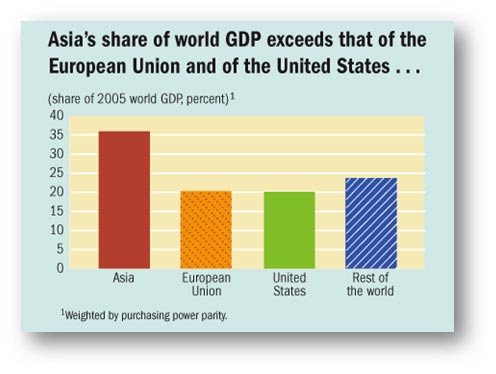

Asia’s share of the global GDP already exceeds that of the US and EU.

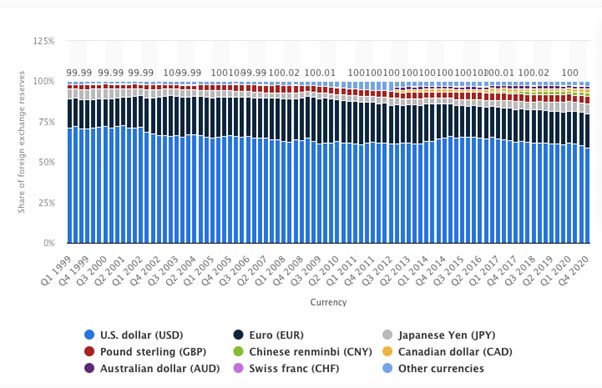

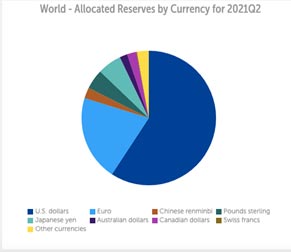

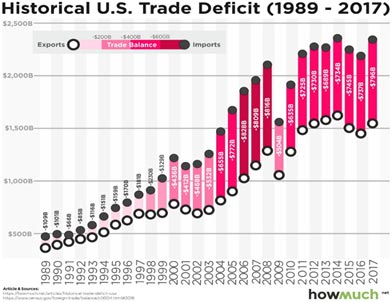

Forex reserves: A major imbalance

There is no crisis as such in the global economy today. But as mentioned earlier, it rests on a weak foundation. One major imbalance in the global economy is that despite being the most indebted nation in the world and running a huge trade deficit, the US is still the best place for countries to park their savings. Indeed, the dollar is the preferred reserve currency for the world. While the relative importance of the dollar has come down marginally over the past 20 years, it is still ahead of other currencies by a wide margin. We trust the US more than any other country and that is where we keep our savings.

The total world reserves in 2021-Q2 was $12.8 trillion, of which 62% was held in US dollars, 20.7% in Euros, 5.2% in Yen and 3.9% in UK Pounds. Almost all of these reserves are held by individual countries in the form of bonds, mostly earning very small interest rates. That may look like money invested in a bank, but in reality it is money being lent to the issuing country.

The issuing countries like the US have little reason to hold many

reserves. Why have reserves when the notes can be printed as and

when needed? The USA’s total reserves amount to about $139 billion.

Contrast this to China’s $3.4 trillion, Japan’s $ 1.4 trillion, Switzerland’s

$ 1.1 trillion and India’s $641 billion.

In 1995, advanced economies held around 67% of total foreign exchange reserves. By 2011, the picture had been reversed: emerging and developing countries held 67% of total reserves. Emerging countries now hold roughly $6.8 trillion in reserve currency.

These figures also indicate that China is heavily invested in the USA.

Despite the posturing by China from time to time, the US can exercise a

lot of leverage over China to ensure compliant behavior.

In short, the rest of the world invests in the USA, so that it in turn can

splurge on itself. When the US is short of money, it just prints some

more dollars, which the rest of us lap up quite happily. And every time

the USA gets into trouble because of its profligacy and economic

mismanagement, the world goes into a tailspin. The USA is the world’s

biggest importer and that is where the world keeps its money.

Countries like China and India produce goods and services at low cost for consumption in the USA. While other nations make goods, the US prints dollar notes to buy them! This money deposited in US banks is then lent to Americans, who today have the highest per capita indebtedness in the world. Many Americans splurge on houses, cars, plasma TVs, computers and play stations which they cannot really afford.

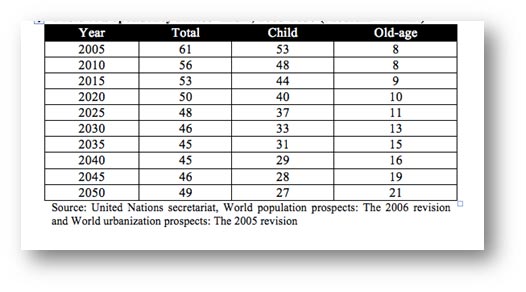

Demographic trends

Demography is important for generating economic growth. Societies with a larger proportion of young people can produce more and grow faster. In the developed world, an ageing society is proving to be a major challenge in many countries. A striking example is Japan which has struggled to grow for the past 10 years.

In China, life expectancy has more than doubled from 35 in 1949 to 75 today. Meanwhile, the fertility rate has plummeted to 1.5 or lower, far below the 2.1 needed to keep a population stable. The country is moving from labour surplus to labour shortage at the fastest pace in history. In 2011, its workforce shrank for the first time, years before anyone had predicted.

Japan reached a similar turning point in about 1990. By then, its living

standards were already at nearly 90% of US levels. In purchasing power

parity terms, China’s per capita income is still below 20%. So as a

leading Chinese economist puts it, “There is now no doubt China will be

old before it is rich.”

India’s dependency ratio is more favourable compared to China. But to reap the demographic dividend, we have to make the young productive. If we do so, we can keep growing till 2090. (The dependency ratio is a measure of the number of dependents aged zero to 14 and over the age of 65, compared with the population aged 15 to 64.) See table above.

One problem India has to address is that in the BIMARU (Bihar, Madhya Pradesh, Rajasthan and UP) states, the population is growing faster while GDP growth is lower, compared to other Indian states. This is a problem we must address quickly.

Asia is predicted to add 2.5 billion people to the world’s middle class in the next 20 years. The middle class in both China and India is growing at an extraordinary rate. China’s middle class could swell to 50% of its population in just 12 years. India’s middle class could rise even more rapidly because Indian households benefit more from Indian growth than do Chinese households, given the prevailing distribution of income.

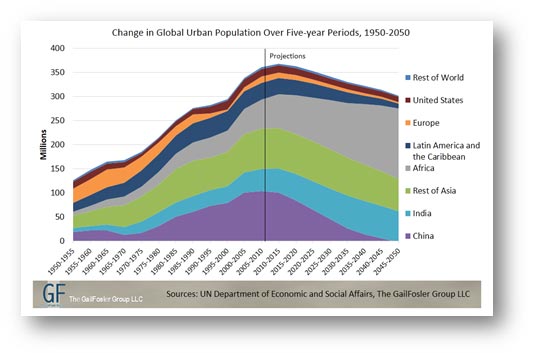

Urbanization

Urbanization will also reshape the world. It is in cities that much of the

world’s wealth is created. While China’s urbanization is slowing down,

we have a lot of room still left to urbanize.

Our track record

Despite the great opportunity in front of us, the track record of the government in recent years has not been inspiring. Demonetization took a heavy toll on the economy. Then GST was hurriedly introduced. After that came the pandemic. Instead of spending liberally during these tough times, our government, compared to many western nations, has been tight-fisted. We have been shooting ourselves in our feet.

The Prime Minister made several bold announcements at the start of his first term such as building 100 cities and running bullet trains across the length and breadth of the country. Unfortunately, we have not seen much action. Even in case of agriculture, reforms have not been forthcoming and bulk of the agricultural production in the country is procured under MSP (Minimum Support Price) with a lot of inbuilt subsidies.

We must get our act together. We have a short window of time to take advantage of the opportunity in front of us. If we miss this, we will not get a similar opportunity for another 250 years.

Q&A session

On the need for political consensus.

Political consensus is crucial for economic development. If political parties fight among themselves all the time, it will be difficult for the country to move forward. Many of these fights do not have any basis. For example, the BJP expressed opposition to the plans for introducing GST by the UPA government. The Congress in turn opposed the BJP when it wanted to introduce GST after the NDA came to power. Leaders like Mr Jawaharlal Nehru and Mr Atal Behari Vajpayee would reach out to opposition leaders, socialize with them and cajole them into agreements where needed. This kind of consensus building is missing today. It does not help that the current government continues to blame Mr Nehru for the problems the country faces today.

On the role of the corporate sector

As a country we cannot afford to be an importer running big trade deficits. We must export more. Indian companies have a big role to play here. Unlike the Chinese, Indian companies have not been able to build global brands. Indian goods are missing in the US supermarkets. In many industries such as air conditioners and refrigerators, we are mostly doing assembly. We do not have an integrated value chain.

We must redefine patriotism. Instead of indulging in shouting matches against Pakistan, we must be focused on capturing global markets. Only the multinationals are exporting cars from India. Contrast this with the Chinese. They purchased MG Motors in the UK and have set up a plant in India and are going global. We must think big and have pride in ourselves like the Chinese.

Indian companies should also draw inspiration from leaders like Konosuke Matsushita (the founder of Panasonic). When he saw during the American Occupation after World War II that an American general was giving instructions to the Japanese emperor, he resolved to get Japan back to its past glory. Matsushita’ s exemplary vision and his phenomenal achievements attracted attention all over the world. When he died, the leaders of the most important nations in the world, including the US and UK attended the funeral. When will we have a corporate chieftain like him?

Indian companies must also build brands. Only if we sell brands, we can capture most of the value addition. If we make commodities or depend on others for global marketing, the value will be captured by others. Maruti is a good example. Through a sophisticated transfer pricing mechanism, Suzuki captures most of the value. In contrast, the Chinese have built quite a few global brands.

On the start-up environment in the country

Mr Guruswamy admitted that he is always in favour of companies making things that are useful to society. The world of apps and video games may make some people rich. But is it really helping society? We are only seeing silos of economic prosperity. While the valuations of some start-ups have skyrocketed (P/E > 150), it is not clear when they will start making money.

On the rising stock markets

Indian stock markets are not driven by the economy. Neither the corporate profits nor the performance of the Indian economy justifies the current valuation.

In the past, influential traders like Harshad Mehta had a big role to play in driving up the prices. In recent years, it is the Foreign Institutional Investors who are calling the shots. They come in and drive up the prices and then book the profits. They re-enter the markets when the valuation is attractive.

Just as Prof James Tobin suggested, it would make a lot of sense to impose a minimum tax on foreign portfolio funds entering the country. But there has been stiff opposition to this idea and the government has backed down. The sad reality is that our markets have become a milch cow of sorts for the foreign institutional investors.

There is no point in just talking about the total amount of foreign investments flowing into the country. We must make a distinction between FDI and FII. Within FDI, we must make a difference between greenfield investments and stakes in existing companies. Only then we will get a more accurate and disaggregated view of foreign investments and their contribution to our economic development.

On cryptocurrencies

For Mr Guruswamy, cryptocurrencies are bogus assets. They are neither authorized nor are they backed by any underlying assets. Some people may be making money as the valuations of crypto go up. But Mr Guruswamy will never invest in such vehicles.

On young India

It is perfectly legitimate for young people to aspire to become successful, earn wealth and start families. But Mr Guruswamy would like to see at least 2-3 out of every 100 young Indians to think differently. We need to produce more entrepreneurs than hustlers. We need entrepreneurs focused on value addition. Consider the Indian IT industry. It exports $ 110 bn of services annually. This is complete value addition as no raw materials are involved.

Concluding notes

We should fight for our rights. From time to time we raise our voice against wrong policies. But we must become mutinous all the time to drive change. We must have a drive and ambition to excel and achieve greatness like the Chinese. Honda captured a large market share in the US with a simple innovation: a coffee mug holder for customers. Americans who like to drink coffee on long rides found this feature very useful. It took 10 years for Ford and the others to react. We need more of this kind of leadership which can come up with seemingly small innovations but that make a great impact.

A thought-provoking session by one of India’s top economists. Great moderation by Prasad and Sudhakar.

We thank Dr. Vedpuriswar for bringing out the highlights in the form of this note