An evening with Dr Santanu Paul

On Friday, June 10, we had a fascinating session by Dr Santanu Paul, the founder and chief executive of TalentSprint, a digital upskilling and bootcamp platform for professionals in search of deep and disruptive skills. The platform aims to equip and empower one million professionals and knowledge workers in the fields of Information Technology, Banking, Financial Services and Education. TalentSprint has received more than 15 national and international awards and raised equity capital from Nexus Venture Partners and angel investors.

About Dr Santanu Paul

Dr. Paul received his B.Tech from IIT Madras and his Ph.D. from the University of Michigan, Ann Arbor, both in Computer Science. His academic record over time earned him the Rackham Doctoral Fellowship, the IBM Canada Fellowship, the LaCroute Fellowship, and the National Talent Scholarship.

From 1995 to 1998, Dr Paul was a Computer Scientist at IBM’s prestigious T.J. Watson Research Lab in Yorktown Heights, New York. From 1999 to 2003, he worked as Chief Technology Officer at Viveca and OpenPages, both venture-backed technology firms based in Boston. From 2003 to 2008, Dr Paul worked for Virtusa Corporation as Senior Vice President for Global Delivery Operations and Head of Indian Operations. He was part of the global leadership team of Virtusa when the company went public on NASDAQ in 2007.

Dr. Paul is an author or co-author of twenty international technology papers and two United States patents. He is an independent board director at the National Payments Corporation of India and NSDL Payments Bank. He is a popular conference speaker and panel moderator, and his op-ed pieces and columns appear frequently in the media.

The rise of technology

Dr. Paul began with the growing importance of technology with a few classic quotes from some well-known leaders:

Jamie Dimon, CEO of JP Morgan Chase: “A modern bank is a technology company in disguise”.

Bill Gates, founder of Microsoft: “All of us need banking but do we really need banks?”

Marc Andreessen, founder of Netscape: “Software is eating our world”.

The rise of Amazon, WhatsApp, Uber, Airbnb, Apple and LinkedIn have adequately demonstrated that tech companies can uproot traditional business models. Banking is no exception.

How the world of banking has changed?

There was a time when a bank was like a church or a temple. The branch manager was held in high esteem by the local community. The approach of a bank could be described in a few phrases: top-down, inside out, command and control. Banks would prescribe the rules and customers would be happy to comply. They were happy to wait in the queue and get the service they wanted.

But today, the scenario has changed completely. Fintech has converted financial services into a bazaar. It is a chaotic marketplace place, bottom-up and outside in. The fintechs believe in collaborative conversations with customers. All this is forcing banks to change. Customers can decide what they want and banks have to adapt to their needs. The phone has become a bank. Customer support must be available 24x7 in the form of bots, etc. The power has clearly shifted from the banks to the customers.

The rise of UPI

We should be truly proud of UPI (Unified Payments Interface), the instant real-time payment system. It is an API built in India that is being used by the most famous names in Silicon Valley. The use of UPI is spreading to other countries as well.

UPI has been developed by the National Payments Corporation of India (NPCI) – a non-profit owned by the Reserve Bank of India (RBI) and 56 commercial banks. In operation since 2016, it is regulated by the RBI. UPI has unified multiple legacy payment systems via an open API architecture.

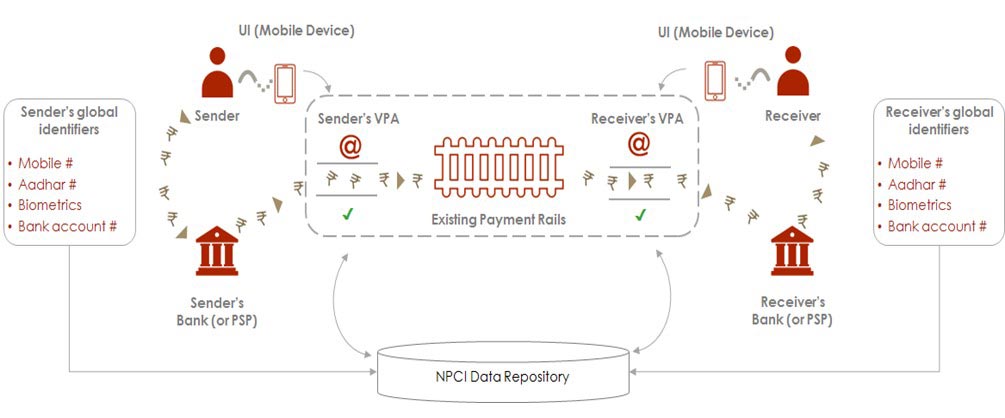

UPI has made payments as easy as sending an email. There is no need to provide details of our bank account. We just need to provide a virtual payment address (VPA). Behind this VPA, we can be connected to any bank account or indeed multiple accounts. VPA serves as a useful abstraction and also hides all the backend work going on behind the scenes. Payments have become frictionless. There are no set up costs. It is feasible to make micropayments efficiently.

Note: The UPI system works by virtualizing accounts, with uniform addresses along the lines of email addresses. It allows a wide range of methods for customers and operators to transfer funds within the system, using a virtual payment address (VPA) or UPI ID, a mobile number, a bank code and account number, an Aadhaar number, or even a QR code which has captured any of the above information. The system operates 24/7, is frictionless/straight-through (i.e. requires no manual intervention) and enables access to funds instantly. It covers all types of consumer-to-consumer (C2C) and consumer-to-business (C2B) payments, as well as many business-to-business (B2B) payments.

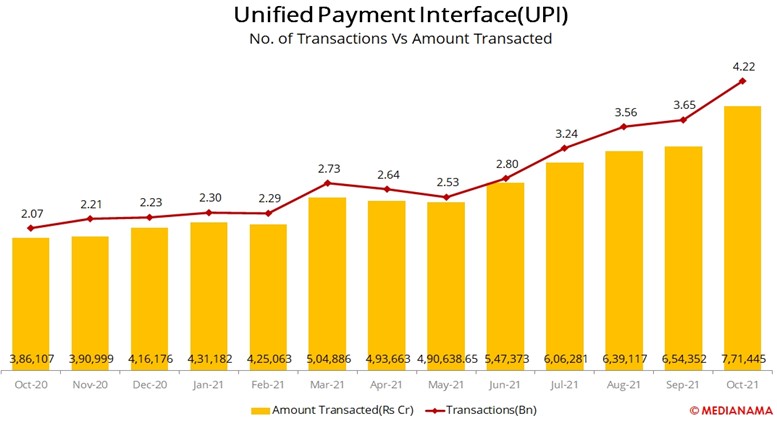

UPI was set up in May 2016. Usage took off following demonetization in November 2016. From 1 million transactions in Dec 2016, it increased to 100 million in November 2017, 1 billion in June 2019 and 1 billion per week in March 2022. In April 2022, 5.58 billion transactions were recorded. By June 2025, we may see 1 billion transactions per day. There are currently 50 + UPI applications on Play Store, 250+ banks, 250 million unique users, and 50 million merchants using UPI.

Thus UPI has grown 500X in 5.5 years and moved from enterprise-scale to citizen scale. Along with UPI, there have been related innovations to deepen the use of digital money:

NETC: National Electronic Toll Collection

NCMC: National Common Mobility Card (RuPay)

National Interoperable Transaction Card (to pay for tolls, parking, metro, bus, etc. across the country)

UPIs, FASTag, Rupay and AePS (Aadhaar Enabled Payment System) have combined to transform the Indian payments landscape. Last-mile financial inclusion has also greatly improved, with 5 million micro ATMs/BCs (Business Correspondents) and 400 million transactions per month using QR codes. In short, the country is going digital on all fronts.

We could say that the rise of UPI was more due to luck. Smartphone adoption had picked up around this time. But a lot of thought also went into regulation. Unlike China which encouraged two large players (Alipay and We Chat) to emerge, in India, the government treated UPI as a public/social good. So no one firm has a monopoly. UPI has been designed on the principle of open architecture. The backend and interoperability are taken care of by the government while the customer experience is handled by tech companies and banks. Of course, the rise of AI/ML has been a big enabler. With such large volumes of transactions happening, even a small percentage of fraud can have a big impact. Thanks to AI/ML, fraud can be detected on the fly and stopped, even as genuine transactions can happen unhampered.

Central Bank Digital Currencies (CBDC)

Most central banks are experimenting with CBDC. China was the first to launch it in 2020. India has been a cautious follower.

A key reason for the rise of CBDCs is that cryptocurrencies have been striking terror in the minds of central bankers. Bitcoins/ether are outside the scope of regulation. They have risen in popularity in the last few years. Crypto’s market cap exceeded $ 2 trillion in 2021. There is a fear that states will lose their power and central banks will become toothless. If payments, deposits and loans migrate from banks into the privately run digital ecosystem of the tech companies, central banks will struggle to manage the economic cycle and inject funds into the system during a crisis. So there was no option but for the central banks to do something. There is a famous saying: If you cannot beat them, join them. The fact that most central banks have been trashing crypto is a clear indication that they think it is a real threat.

CBDC is fiat currency in digital form. The money is guaranteed by the government but exists in digital form. Currency notes (M0) are replaced by digital money.

CBDC offer various benefits:

GDP Efficiency: It is possible to generate savings of upto 1% of GDP on account of doing away with the printing and recycling of currency notes.

More effective monetary policy: With CBDC, central banks will find it easier to impose negative interest rates. The presence of cash in the economy sets a floor on the interest rate, ie 0%. With digital currency, negative interest rates can be easily implemented. This will provide considerable flexibility to the central banks to implement monetary policy during times of recession

Monitoring: It is easier to prevent money laundering, terrorism financing, tax evasion, etc. with digital money.

Financial inclusion and distribution: Money can be quickly put in the hands of the citizens when the need arises. Consider a cyclone in the Andaman and Nicobar Islands. Money can be moved into digital wallets in an instant. There is no need to ship currency notes. CBDC can also broaden financial inclusion by facilitating digital payments even for those without bank accounts and debit/credit cards and by serving as a gateway to other financial products.

Instantaneous clearing and settlement: CBDC minimizes the risk of unsettled transactions.

Citizen scale analytics: The central banks can understand spending patterns, and how they vary across segments of the population and regions. This way they can fine-tune their policies far more effectively.

Efficient cross-border payments: This is a huge problem. It is estimated that the cost of friction is 8%. CBDC can remove this friction.

Programmable money: Digital money is programmable. We can do things that are not possible with traditional money. We can ensure that money is used in exactly the way it is intended to, like for example a vaccination dose. During a hurricane, we can ensure that the money is used only to buy essential items such as food. During a recession, we can ensure that people spend money on consumer durables. That is not easy to achieve with traditional monetary policy (lower interest rates.) We could also ensure that the money is used by a certain date. Otherwise, it will expire.

The downside of CBDC is that we may see the rise of a surveillance state. Citizens will have to give their information to the state which will know what we are doing. Though central banks claim that surveillance is not on their mind, the traceability of all digital transactions eliminates effectively the possibility of using central bank money for anonymous transactions. As Dr. Eswar Prasad, an expert on the subject points out, in every country that is contemplating the use of CBDC, there is a need for social consensus regarding the loss of privacy associated with the shift to purely digital forms of money.

Another potential downside as Dr Eswar Prasad points out is that actions such as “helicopter drops of money” (pumping money into digital wallets of the general public to boost spending) could blur the line between an independent central bank and the government. Central banks might be seen as agents of government policies, thereby undermining their independence and credibility.

Architecture options

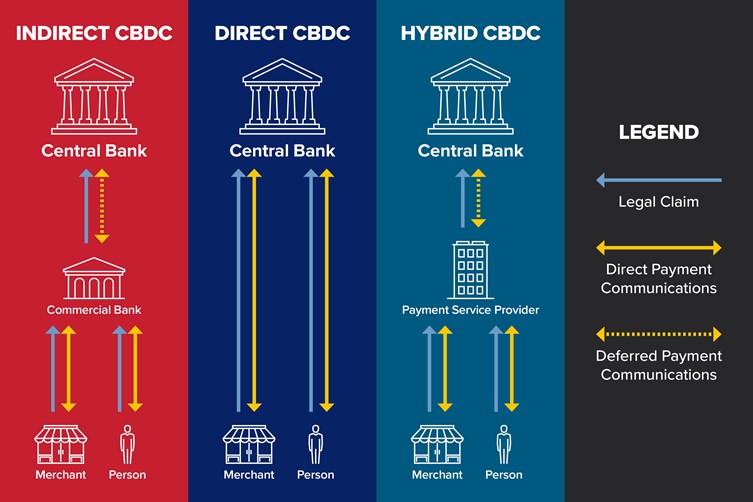

Indirect CBDC means individuals and businesses interact with the central bank through the commercial banks.

Direct CBDC means individuals and businesses interact with the central bank directly.

Hybrid CBDC means that individuals and businesses interact with the central bank through a payment service provider.

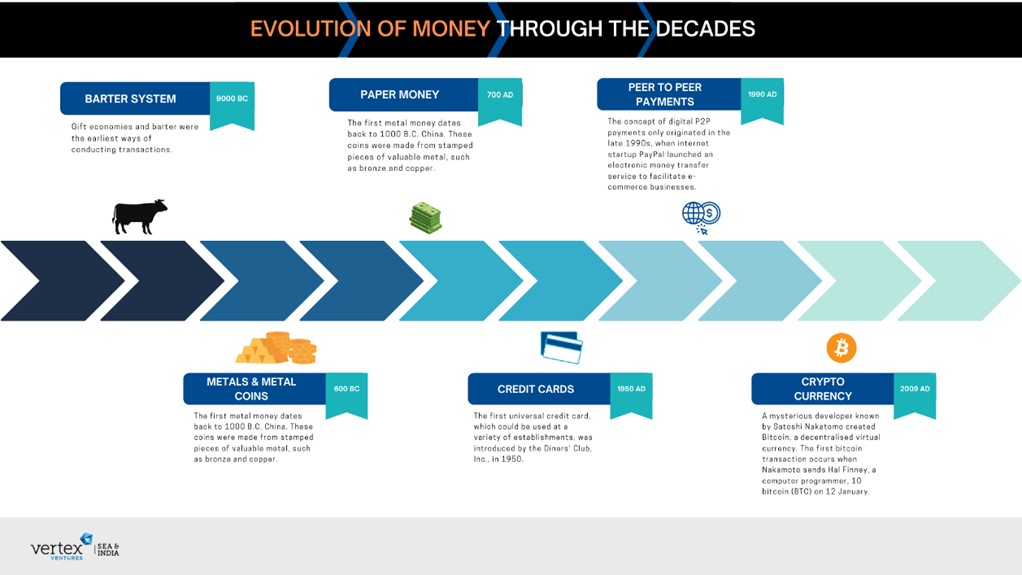

Money has evolved over the centuries. Digital money is the latest format. Dr Paul explained this with the help of the slide below:

Q&A

On Open Network for Digital Commerce (ONDC)

Web 1.0 was fairly democratic. Information could be exchanged using hyperlinks. Web 2.0 has seen the emergence of powerful companies like Google, Amazon and Facebook. There is a fear that we are becoming excessively dependent on these platforms and cannot leave them even if we want to. There are allegations against Amazon that it can study the operations of successful retailers on its platform and then replicate the strategy and undercut the price of the product. Just like in UPI, there is no monopoly, ONDC has been conceived to ensure that small businesses are not at the mercy of any one aggregator.

Note:

Open Network for Digital Commerce (ONDC) aims at promoting open networks for all aspects of the exchange of goods and services over digital or electronic networks. ONDC is based on open-sourced methodology, using open specifications and open network protocols independent of any specific platform.

ONDC will have open protocols for all aspects in the entire chain of activities in exchange of goods and services, similar to hypertext transfer protocol for information exchange over the internet, simple mail transfer protocol for exchange of emails and UPI for payments. ONDC protocols standardize operations like cataloging, inventory management, order management and order fulfilment. Thus, small businesses can use any ONDC-compatible applications instead of being governed by specific platform-centric policies.

ONDC will make e-Commerce more inclusive and accessible for consumers. ONDC will standardize operations, promote inclusion of local suppliers, drive efficiencies in logistics and create value for consumers.

On the available entrepreneurial opportunities

Exciting opportunities are available for entrepreneurs in various areas: payments, digital lending, micro insurance (India is a heavily underinsured country.), bots for customer service. Combining domain knowledge with AI/ML/Data Science and Block chain, there is a lot that entrepreneurs can do. Dr Paul stressed that we should choose something we are truly excited about. Ultimately the success of an innovation depends on the quality of the idea.

On Web 3.0 (Metaverse)

There are clear signs that the virtual world is getting bigger and bigger. By 2035, we may spend a large part of the daytime in the virtual world. The combination of VR/AR/Crypto/Gaming/NFTs will create exciting opportunities. People who are both analytical and creative (who can use their left and right brains) will thrive in this world. Design will be as important as technology. Currently, there is a lot of hype around the metaverse. But when the dust settles, we may see something profound. This will take 5- 1o years to play out. But we must remember that ecommerce also took 20 years to really scale up. In the history of human civilization, this is a short period of time.

On the future of CBDC

One tier architecture with account based CBDCs may not take off. Central banks are not good at handling retail customers. Customer service may not be the priority of a central bank. It is the two tier architecture where we interact with the central bank through the commercial banks that is more likely. Dr Paul feels that commercial banks will remain in business. However, as digital currency takes off, ATMs may begin to disappear.

On privacy

Digital money is more traceable. The digital economy is antithetical to the idea of privacy. While we proclaim that privacy is important, we are quite happy to maintain free YouTube accounts and surrender our data to Google. There is a dichotomy and irony that we have to live with. For all the proclamations of central banks that transactions will be anonymous, we do know that traceability will be very high in the digital world. For example, there are clear signs that the Chinese government will try to gain tighter control over the lives of citizens using CBDC.

Is India ready for a digital currency?

Our literacy levels may be low but we have adapted to digital technology quite fast. We have also made sure that technology is customized to suit our needs. The India stack and FASTag are good examples. Literacy is not a precondition as demonstrated by the rise of UPI. Young people have never visited a branch. Now they may stop visiting ATMs. With voice enablement, many technologies will become user friendly and almost anyone can use them.

CBDC vs. Cryptocurrency

CBDC is for making payments. It is not for investment. Crypto today is primarily an investment vehicle. The people who promoted crypto believed that central banks have diluted the value of currency by excessively expanding money supply. In a way, they are rivals. But each may serve its purpose. So the two worlds may coexist.

On whether CBDC discharge the traditional functions of money

CBDC is nothing but fiat currency in digital form. It can discharge all the functions of money: transactional, precautionary and speculative. But because of its digital nature, its programmability and seamless movement, it is more versatile. The efficiency of transmission of monetary policy can be amplified with CBDC. Also, by suitable programing, the need for escrow accounts can be eliminated.

Concluding notes

The Economist (in its annual survey of banking, April 20, 2022 and other articles in recent months) has pointed out that if citizens can convert bank deposits into central-bank money with a simple swipe, deposits would move out of the banking system and onto the central bank’s balance-sheet, disintermediating the banks. The US Federal Reserve’s balance-sheet may grow from $8 trn to a whopping $21.5 trn. Who, then, would provide the $15trn of loans that banks now extend to the American economy? Perhaps a central bank could simply pass the funds back to the banks by lending at its policy interest rate. But the Federal Reserve extending trillion-dollar loans to the likes of JPMorgan Chase or Bank of America would be politically controversial, to say the least. If retail banks cannot lend to businesses, the central bank and consequently government bureaucrats might influence credit allocation. Very intriguing possibilities. We have to wait and see how CBDC evolves.

We thank Dr. Vedpuriswar for bringing out the highlights in the form of this note