Customer in the boardroom

On Friday, March 24, we had a very engaging session by Mrs Rama Bijapurkar.

About Mrs Rama Bijapurkar

Rama Bijapurkar is a researcher, an academic, an author and a business advisor and also one of India's most experienced independent directors. She is an ardent evangelist of putting the customer at the centre of business thinking.

Ms Bijapurkar is author of several bestselling books like “We are like that only: Understanding the Logic of Consumer India”, “A Never-Before World: Tracking the Evolution of Consumer India and “Customer in the boardroom: Crafting Customer-Based Business Strategy”.

Ms Bijapurkar has been a visiting faculty and a professor of practice at IIM Ahmedabad, where she teaches second year PGP and Executive MBA students. Among other courses, she offers a course called Customer Based Business Strategy.

Ms Bijapurkar has served on the boards of reputed companies like ICICI Bank, Infosys, Mahindra Finance, CRISIL, Cummins India, Nestle India, National Payments Corporation of India, Apollo Hospitals and Sun Pharma. She has also served on the boards of public institutions like IIM Ahmedabad, Banking Codes and Standards Board of India, etc.

Introduction

Mrs Bijapurkar started by pointing out how little the customer is part of senior management conversations. In fact, the more senior the management, the less the focus seems to be on customers. The word customer often appears in some obscure portion of strategy documents. Senior executives also find it difficult to describe the business through the lens of the customer.

The reason for this situation is simple. Indian companies have found growth relatively easy, with limited competition. As the country has developed, the rich have become richer (the trend has strengthened during the pandemic) , creating easy growth opportunities. It has just been a matter of catching the rain.

For most companies, strategy has equated to being present in different segments, expanding the product range, widening the distribution network, increased operational excellence, execution focus, moving to adjacent areas, acquisitions, and partnerships. The only place where there is some connection with the customer is when senior execs talk about the brand. Otherwise, business strategy is disconnected from customers.

Mrs Bijapurkar added during the Q&A that only when competition intensifies, customer orientation will become strong. (Telecom companies are now understanding the importance of network quality.) Right now, growth masks the underlying problem. The motivation to really understand the customer is low. It will take some time before customer inputs go into strategic planning and customer related KPIs are given more importance than market share.

Wearing the customer lens

Whether it is revenue, cost, or profit, we should be able to connect the business metric with the customer. Consider a key metric like market share. It is just a number which can be calculated as per our convenience. It has meaning only when we relate it to the customer. We should keep asking: Which customers are buying our product? Which customers are walking away? How can we fulfil their needs and persuade them to buy more of our product? If the market is shrinking, we must ask: Are customers embracing some substitute?

We should diagnose the problem of sales growth wearing the customer lens. If sales of consumer durables are not growing fast enough, we must not equate it with lack of demand. We are living in a gadget driven economy.

Everyone is looking for gadgets. If we are not able to sell enough of our product, we must ask ourselves whether our strategy is aligned with customer needs.

Understanding disruption

There is a lot of hype around disruption. But fundamentally, disruption is a simple concept: perceived customer value. If a competitor provides more benefits at the same cost or the same benefits at lower cost or more benefits at a lower cost, disruption will occur.

Understanding Blue oceans

There is also a lot of hype about blue ocean strategy. Again, the concept is simple. It is about finding unserved or underserved customer groups. During the Q&A, Mrs Bijapurkar mentioned that for a company trying to grow sales during recession, the only realistic option is to look for blue oceans.

Nirma is the Indian company which first implemented this strategy in the 1980s. But there are many other opportunities as well. Consider travel from Pune to Mumbai. There is a crying need for convenient flights, but they are missing today. It is by capitalizing on such opportunities that faster growth can be achieved. Sometimes blue oceans can be created by combining two types of needs such as education and entertainment.

Getting back to strategy

As Kenichi Ohmae pointed out, strategy is not about focusing on competitors. It is about adding value to customers. The best approach is to avoid a competitive battle altogether. It is very much possible to create wealth for the company's shareholders by creating value for customers. The tranny of “or” need not hold companies back.

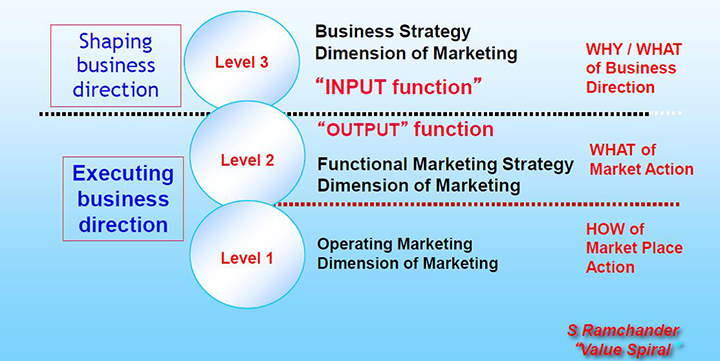

If we divide strategy into three levels, today, for most Indian companies, marketing is more of an output rather than providing inputs into strategy:

Level 1: Executing business direction: How of marketplace. Output function.

Level 2: Executing business direction: What of market action. Output function.

Level 3: Shaping business direction: Why/What of business direction. Input function.

During the Q&A, Mrs Bijapurkar explained this in more detail. In most companies, customers are addressed mainly by the functional marketing department as part of strategy execution and not as an input to strategy.

There is more talk about customers these days. But practices have not changed much. There is some degree of customer centricity while executing strategy but not during strategy formulation.

Customer focused strategy

What we need is a customer focused business strategy. Most business leaders and management consultants focus on business understanding. Market research companies focus on understanding customers. We need a combination of the two: good understanding of the business and the customers.

During the Q&A, Mrs Bijapurkar added that the cost structure of management consulting firms holds them back from a more customer focused approach. It takes time (often 6-8 weeks) to come up with a customer based segmentation strategy.

A customer-based business strategy has three elements:

Choose: Promise value to a set of customers

Align: Design how to deliver the promise.

Communicate: Signal the value to customers at all touchpoints

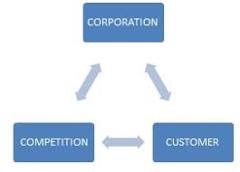

Ohmae's strategic triangle

Ohmae’s 3C Model was developed in 1982. The model integrates the 3 most critical elements that managers should be focusing on: Customer, Corporation and Competitors. The model states that neglecting any one of these factors when designing a strategy will have serious consequences for its success. Not only is it important to analyse each of these factors in isolation, but also how they interact with each other.

S Ramachander: Value spiral

Prof S Ramachander has explained how to apply innovative thinking to all aspects of the value chain, from insightful discovery to designing and developing a product to delivering it to the consumer.

Bifocal vision

Companies must have a bifocal vision, combining inside out and outside in approaches. The focus should be both on creating customer value and developing the internal capabilities for creating such value.

Concluding remarks

The customer is the person who makes the P&L happen. Companies cannot afford to lose their focus on customers. The customer must be an integral part of boardroom discussions.

B to B companies have a good understanding of the customer’s profile and what they are buying. But they do not really understand the business of customers. B to C companies fare no better. Take insurance. Few companies can answer the question: Why is it that in a country of so many self-employed people, health insurance penetration is so low? Consumer goods companies too do not get the big picture.

Some of the metrics companies can use to really understand customers are: brand perception among non-users, more granular performance measures across segments (like wealth management and insurance separately for insurance companies which may be in both businesses) and geographies.

Mrs Bijapurkar gave the example of Amazon. It has tried its best to understand the Indian customer. The company offers cow dung cakes for pujas, five varieties of grinders, various kinds of hair pins, different varieties of rice including red rice and back rice. Amazon has also pioneered the concept of no questions asked returns. The company has truly understood the importance of the equation:

Benefits – Price= Value for customer.

VC investors keep oscillating between growth and path to profitability. During the good times, they tend to focus on P/E and valuation. During the tough times, they focus on profitability. Now there seems to be a welcome emphasis on unit economics.

The differences have narrowed down considerably over time. 50% of India’s rich live outside the urban areas. Due to greater awareness and exposure, even the poor in the rural areas aspire for a better lifestyle.

The target segment may vary across companies. For companies such as Nestle and Emami, which are primarily urban centric, the focus may be on expanding to richer parts of rural India. Other companies might target emerging rural or underdeveloped rural areas. For car manufacturers, the target segment may depend on the quality of the roads. In some rural areas, the roads are quite good. Thus, the customer driving patterns may become the basis for segmentation.

It is true that opinions of customers are shaped by the social media. But companies cannot watch passively as this happens. They have no control on the social media. So they must proactively demonstrate their customer centricity. Responding to another question, Mrs Bijapurkar mentioned that different departments of large multi business companies may have their own social media departments. But they must work in harmony and convey a unified message to customers.

The Maruti 800 was a roaring success. But why did the Nano not succeed? Mrs Bijapurkar mentioned that timing matters. When Maruti entered the market, the competition from the Ambassador and Fiat was relatively weak. There was not much retaliation from the existing players who were probably complacent. But when Nano entered the market, Maruti and the others were far more formidable competitors.

Mrs Bijapurkar added that consumer behaviour can often surprise us. In the case of the TVS Boxer, the more expensive version with more features found acceptance among the relatively less affluent customers while the rich preferred the lower priced version. The reason was that for the poor, the two wheeler was the main transportation vehicle while for the rich, it was the car and the two wheeler was only occasionally used.

Mr Bijapurkar recalled the important equation:

Benefits – Price= Value for customer.

If a price increase happens without any rise in benefit (or without protecting the benefit) , the customer will be put off.

Any important decision in the organization like cost optimization should be taken keeping the customers’ interests in mind. Customer centricity should be embedded in the fabric of the organization and should flow across layers just like intravenous drips which go into our body.

Later, Mrs Bijapurkar added that customer advisory boards or councils by themselves may not be able to change the culture. It is also important for senior execs to go out into the field, meet customers and pick up customer insights some of which might be quite contrarian. This is what Alyque Padamsee (Lintas execs were asked to watch movies.) and Hindustan Lever expected from their senior management team.

These incidents reflect a deterioration in personal values and reflect a sense of entitlement. They also reflect the inability to control oneself and hence openly airing one’s frustration in public. It is ultimately a failure on the part of the leadership to shape the culture of the organizations to which these erring individuals belong. Aggressive targets can lead to cheating. On the other hand, by reducing sales targets and removing products that were not appropriate for customers, a bank CEO was able to change the culture of his organization in a matter of 6 months.

Faculty carry a great deal of responsibility on their shoulders. They have to strike a balance between playing to the galleries and doing what is in the best interest of students. Ultimately, customer centricity is not about doing whatever the customer is asking for. It is about doing the right things on behalf of the customer. Mrs Bijapurkar added that middle and top management talent has been one of the main exports of the country. The faculty should get due credit for this.

Prasad added that it is important to understand the student profile and design the appropriate value chain. The needs of students in Tier 2 and Tier 3 institutions are quite different from those of the IITs and IIMs. Aping the best institutions may not be the right approach for the lower ranked institutions. Some institutions are also focusing all their energies to meet the NIRF requirements. This is again not an advisable approach.

HUL operates in a limited space. Reliance may find its own segment. So, the chances of head on competition are less.

We should counsel the erring person. If the behaviour does not change, we should take it up with the chairman. If the behaviour persists, it may make sense to resign from the board.