An evening with Dr Jayaprakash Narayan

On Friday, June 23, we had a fascinating session by Dr Jayaprakash Narayan, former IAS officer and social activist. The full session is available at:

https://www.youtube.com/watch?v=-DzXOwmCl8cAbout Dr Jayaprakash Narayan

Dr Jayaprakash Narayan is a physician by training. He served as a member of the Indian Administrative Service for 16 years. He had a tremendously successful tenure and held many important positions in the government of Andhra Pradesh. During his service, Dr Narayan acquired deep insights into the Indian governance process and the problems facing the nation.

Convinced of the need for radical reforms to transform Indian governance, Dr Narayan left the civil services in 1996. With likeminded colleagues, he founded the Foundation for Democratic Reforms (FDR) and Lok Satta, a people’s movement for governance and political reforms. Since then, FDR and Lok Satta have emerged as leading civil society initiatives for governance reforms. They are now focused on true federalism and effective and accountable local governments, rule of law, education, healthcare, and agriculture.

Introduction

Political and governance reforms take time and need a lot of patience to implement. But one important lever of change, we must focus on, is economic. If we can achieve sustained economic growth (6-7%) over a long period of time, we can lift many people above the poverty line. Moreover, growing affluence will generate momentum for more political reforms. While the economic growth opportunity is real, it is possible only if the public finances are in good shape. In this context, Dr Narayan pointed out that some of the steps taken by the states in recent years pose a real danger to our growth prospects.

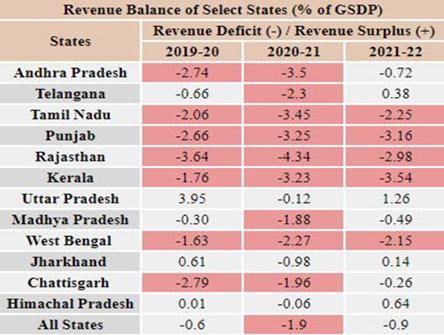

Revenue deficit

Many State Governments are incurring revenue deficits, ie the running expenditure exceeds the revenue. This implies that current day-to-day expenditure is financed by borrowing. If this continues, the debt burden will keep increasing without any increase in the capacity to repay the debt.

The ‘Golden Rule’ of public finance states that a government should borrow only to incur Capital Expenditure (investment) and not to fund Revenue Expenditure.

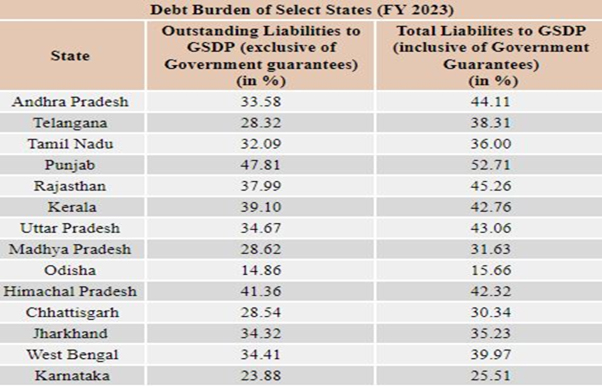

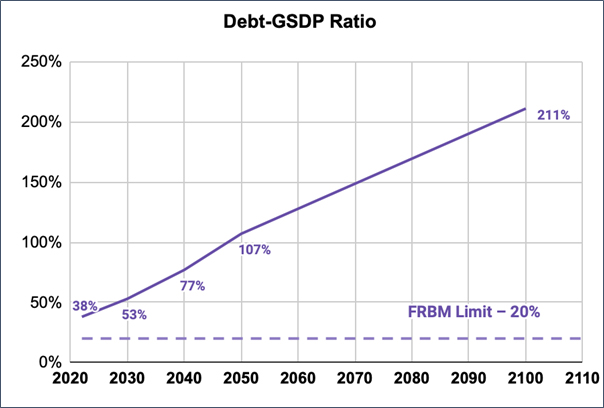

Debt to GDP ratio

This ratio is going out of control. The Debt to GDP ratio prescribed by the Fiscal Responsibility and Budget Management Act, 2003 is 40% for the Union and 20% for the States. But many states have violated this norm. Orissa is an exception and illustrates what a far sighted and proactive government can achieve. Karnataka also has done reasonably well in controlling the debt. But most states are faring poorly in this regard, with Punjab leading the pack.

If debt reaches 100% of GSDP (Gross State Domestic Product), it means (assuming an interest rate of 8%) about 8% of GSDP is going towards interest payments. Tax revenues make up only 19% of GSDP. This means about 40% of the revenues are eaten up by interest payments. Not a happy situation to be in!

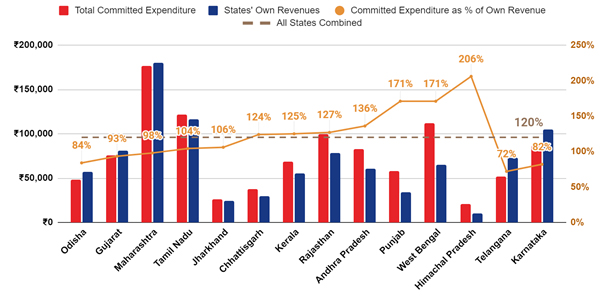

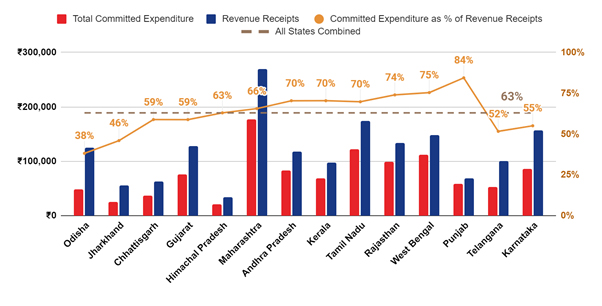

Poor fiscal management

A serious challenge is the high proportion of committed expenditure, i.e. salaries, pensions, and interest payments. Committed expenditure accounts for 63% of total revenues of States. The pension outgo itself is around 14.3% of all revenue receipts for all states combined.

Committed expenditure accounts for 120% of the States’ own revenue receipts. The pension outgo as a share of own tax revenues is around 27.4% for all the states combined.

The pension burden

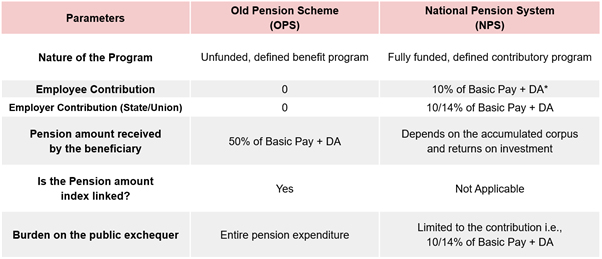

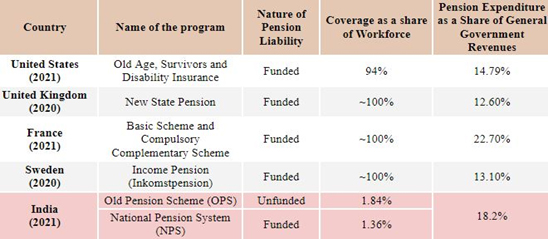

In the developed countries, pensions are funded with payroll tax and not with taxpayers’ money. The entire population is covered by some form of social security. In India, for a long time, we had an unfunded pension scheme (Old Pension Scheme or OPS). Only 3% of the workforce, consisting mostly of employees in the organized sector, were covered. This is a vocal group. Politicians are terrified of losing their vote. They are less concerned about the silent 97%.

State government pension liabilities have more than trebled in a decade. Nearly 90% of the pension expenditure goes towards funding liabilities under the OPS. In three decades, the pension burden as a share of States’ Own Revenue and Total Revenue has trebled.

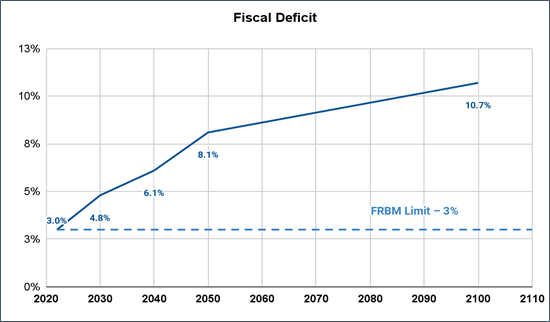

It was against this background that the New Pension Scheme (NPS) came into effect in 2004. NPS is a fully funded defined contribution program. The benefits of the NPS will start to accrue after 2034 (approximate year of retirement for recruitees under NPS). NPS was started by NDA and pushed by NPA. Unfortunately, after 18 years of successful running, many states are now reverting to OPS out of political compulsions. If this trend continues, the fiscal deficit may hit 8% of GSDP by 2050. This means that the entire tax revenue will be eaten up by pensions.

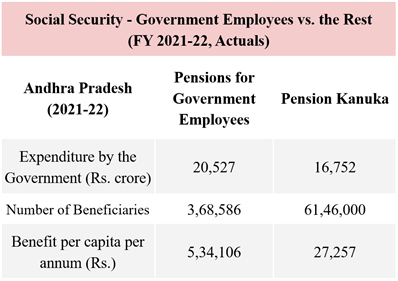

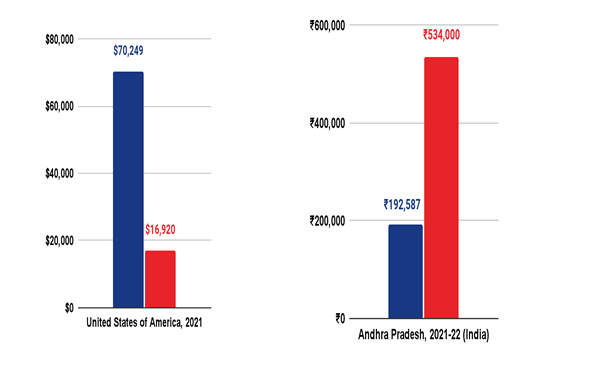

The following graph illustrates the situation in Andhra Pradesh.

A skewed social security system

With a skewed social security system, a minority of the population receives substantially higher social security benefits.

Protecting the future

- As in many other countries, we must implement the ‘Golden Rule’, ie curb borrowing for current expenditures. The revenue deficit should be zero for the states. There should not be any borrowing without creating assets.

- Under the Indian constitution, states cannot go bankrupt. The central government guarantees the debt of the states. On their part, states must take the permission of the centre before borrowing. States should be required to meet and maintain zero revenue deficit targets (and later revenue surplus targets) under Article 293(4) as a condition for consent to borrow. The center has the responsibility for imposing such discipline.

- States must show future pension liabilities in the current budget to ensure intergenerational equity. No government has the right to impose a burden on future generations through reckless spending for political gains. The cost of decisions should not be concealed to be borne later.

- We must progressively increase the retirement age in keeping with the increase in average life expectancy and the best global practices. This will help us to leverage the expertise of experienced people and reduce the pension burden.

- We must grow at a rate of 6-7% + for the next 25-30 years. Otherwise, the future will be bleak. And for that to happen, fiscal discipline is important.

Q&A

When the borrowing exceeds prudent limits, credit rating falls and interest rates go up. The country can fall into a debt trap.

Moreover, when the government borrows heavily, the private sector has less money available to borrow. This is called the crowding out effect.

As the debt burden increases, more and more of the revenue goes towards interest expenditure. There is a funds crunch and infrastructure spending goes for a toss.

The education and healthcare sectors are in shambles. If the debt burden crosses prudent limits, the two sectors will suffer due to lack of investment. Without good education and healthcare, we cannot have a productive workforce.

Foreign investors will hesitate to enter the country. They will move to more attractive destinations.

We should not dismiss politicians as an irresponsible group. There are many politicians who are thinking seriously about the problem of fiscal indiscipline and how to address it. Unfortunately, the political structure today is such that parties want to be in power at any cost. Moreover, the centralized structure means that there is little consultation. The voices of many right-thinking people in the parties cannot be heard.

We must wake up the unorganized 97%. The fight today is between a small number of powerful organized people and a large number of weak, unorganized people. To protect the long-term, short-term battles must be won. But we cannot focus only on the short term, i.e. winning elections.

The NPS was introduced by the minority NDA government and taken forward by the minority UPA government. This shows that a significant part of the political leadership understands what needs to be done. At the state level, Orissa has demonstrated that it is possible to win elections and generate economic growth while maintaining fiscal discipline.

Dr Narayan is working closely with likeminded people. He is organizing a national round table. He is reaching out to every political party and the parliamentary committee on finance. Logic and evidence alone are not enough, We need to mobilise more people. Out of the 97% people in the organized sector, if we can awaken even 10%, it will be a major step forward.

Dr Narayan explained that what we call freebies are nothing but individual short term welfare measures. In any democracy, people must be carried along. So, such measures are needed. Take the US for example. The government put a lot of money into the hands of people as the pandemic broke out. (This is now causing high inflation.) The US has also on occasions waived off student loans. The real issue is striking a balance between such measures and long-term investment and growth.

While these individual short-term measures have been criticized, they are nowhere near as costly as the OPS. Moreover, if real GDP grows at 6-7%, with an inflation of 4-5%, the revenues will increase by about 12-13% every year. So as long as we freeze the current spending, such measures will be sustainable. As a democracy, we cannot survive unless relief is given to poor people. So doctrinaire approaches must be avoided.

We can come up with suitable messaging and leverage the social media. We must use simple language and reach out to a large number of people. Attention spans are limited. GDP and fiscal discipline are not exciting news compared to the drama surrounding celebrities and politicians. The media is usually dominated by dramatic political events. Issues such as fiscal prudence do not get enough media attention. Indeed, across the world, to draw the attention of the public to items which are important in the long term is incredibly difficult.

So we must get the support of creative people to craft messages that stick. We must pool our resources and reach out to a large number of people to sensitize them about this very important problem. Digital means of communication if properly managed can go viral.

This is a huge challenge, not only for India but even globally. Notwithstanding the common perception and our self-image, we are one of the least educated people on the planet. If a few Indians are leading global companies today, it is despite our educational system.

A survey by Pratham reveals that many children in the age group 14-18 cannot look at a watch and read time. Many children cannot count currency notes or do not know how to use weights. In short, the educational outcomes in schools are appalling. Colleges are no better.

Our education system is characterised by rote learning. The problem is compounded by mass copying. There is an unnecessary obsession with marks. There is little emphasis on conceptual knowledge and problem-solving skills.

The good news is that the demand for education is strong. If we identify the right outcomes and measure them intelligently and honestly and move away from the focus on marks, things will work out fine. There is an intrinsic hunger for education. Indians want to succeed. There are many opportunities.

Birth rates and death rates are falling across the world. India is not an exception. However, the ageing of society is not a serious problem for us as of now. But it will be in a few years from now.

If our reproductive rate is above 2.1, the population will keep growing. If it is below 2.1, it will fall. The national average is currently 2.0. Some states like AP, Kerala, Telangana, Karnataka have already reached 1.6-1.7. In a few decades, the country as a whole will reach 1.7-1.8.

Already, the number of children going to schools has started to fall. Instead of setting up more schools and recruiting more teachers, we must make better use of the existing resources.

We have enough working age people. What we need to do is to make them productive.

In India, the family ties are strong across religions and castes. There is an intrinsic desire to succeed. Parents are willing to make sacrifices. As long as the state does a few sensible things and the private sector responds to market forces, the problem is not insurmountable.

Agriculture today is inefficient with a long supply chain. We must compress it. The private sector should be incentivized to make investments in sourcing, logistics, storage, packaging, and retailing. In a well-functioning supply chain, the realizable value must be 70% of the market price. But in India, it is about 25%. That is why the vendors from whom we buy vegetables daily find it difficult to make their ends meet. We have not paid enough attention to value addition in agriculture. With the right strategy, we can easily export agricultural items worth $ 100 bn.

For almost 10,000 years, our focus was on feeding ourselves. So agriculture was the mainstay of the economy. But over time, we have created the ability and capacity to feed ourselves. Our needs have also grown beyond basic needs. We aspire for better things such as clothes, mobile phones, computers, etc. So, the number of people in agriculture will continue to fall. Indeed, people moving out of agriculture is an inevitable part of modernization. What we should focus on is greater value addition in agriculture. This will improve the incomes of those still in farming.

If people do move out of agriculture, we need not get alarmed as long as they are able to find alternative sources of livelihood. The inescapable trend is that agricultural production continues to rise even as prices fall. Today, a monsoon failure does not have as much impact on food prices as at the time of independence. The Russia Ukraine war has had little impact on food prices, despite the concerns expressed last year.

If at all we need more farmers, we must incentivize them. There is no need to romanticize farming. Farmers cultivate crops to feed themselves and make a profit. If the incomes are good, they will continue. Otherwise, they will shift to other occupations.

We must encourage in situ urbanization, i.e. the development of towns near the villages. Forcing the poor to shift to the big cities with no skills or shelter, live in inhuman conditions and with a real danger of alienation does not make sense. We must encourage the growth of small towns. It is much easier for villagers to migrate to such towns and find opportunities to monetize their skills. This way synergies between villages and smaller towns will also develop.

We have also ignored labour intensive manufacturing sectors. In garments, we have few companies employing thousands of people. In leather, we cannot claim much value addition. China always encouraged labour intensive manufacturing. We must reimagine our development model.

The government used a moral persuasion campaign to persuade people to give up gas subsidies. Can something similar be tried with OPS?

Gas subsidy involves a small amount. But OPS operates on a bigger scale. Someone who retired many years ago, with an income of Rs 10,000 a month may get Rs 70-80,000 today after inflation indexation. This is too large an amount for people to give up. Charity and individual sacrifice cannot be the basis for a sound public policy.

The government has done a few things right.

Before the first state assembly elections, an attempt was made to draw a distinction between indigenous Telangana people and those who migrated from other parts to Telangana. After the elections, good sense prevailed and this distinction was rightly withdrawn.

The importance of Hyderabad city (30% of the population and 80% of the economy of the state) has been safeguarded. The good work done to develop Hyderabad continues.

The government has also shown it is keen on getting investment and growth.

But in terms of fiscal discipline, it has been a sad story. A state with arguably the best finances in the country finds its surpluses completely wiped out. Short term individual welfare remeasures have played a role. But even more importantly, major capital investments with low ROI have been pursued. Dr Narayanan is all for irrigation. During his days as an IAS officer, he brought low cost irrigation to lakhs of acres of agricultural land. But the current government’s focus on high-cost irrigation (Rs 30,000-40,o00 per acre per year) is difficult to justify.

There are already rumours that because of the funds crunch, pensions and salaries are getting delayed every month. The government is also using its overdraft mechanism with RBI.

Internal democracy within the political parties is important. How candidates are chosen for election and how leaders are elected, and funding should be transparent.

Too much money is being spent on elections today. In two assembly constituencies of Telangana, Rs 250-35o cores were spent on by elections. This is more than the spending of two major parties across the country in the 2019 parliamentary elections. We must change the incentives. Currently, parties are spending huge amounts of money to get past the line. If we move to proportional representation, the incentive to spend huge amounts of money to win elections with unfair means may reduce.