An evening with Pallavi T Madhok

Introduction

On December 15, 2024, we had an insightful session on women’s financial inclusion with Ms Pallavi Madhok, Vice President - Advisory Services, South Asia, Women’s World Banking.

About Pallavi Madhok

Ms Madhok, an expert in women’s financial inclusion, works with partner institutions to develop innovative products and solutions that unlock value for their women customers and stakeholders. Her prior experience includes product management and management consulting.

She graduated from Economics (Delhi University) and an MBA from the Indian Institute of Management – Bangalore.

About Women’s World Banking

Women’s World Banking is dedicated to serving the 1 billion women excluded by the formal financial sector. We partner with financial institutions and policy makers to design and develop solutions and programs that facilitate systemic change for women through building access to finance, bias-free data, and gender-lens investing. We advance women in the workplace and as customers through direct equity to bring financial security, prosperity, and independence to women.

Since 1979, Women’s World Banking has worked with financial institutions to demonstrate the benefit of investing in women as clients and as leaders. Women’s World Banking has partnerships with a diverse range of financial service providers, including microfinance institutions, commercial banks, fintechs, mobile network operators (MNOs), and insurance companies .

The problem

One billion women globally are unserved or underserved by formal financial services. Even when these women have access to financial or technological tools, they are uncomfortable and under-confident in using them.

Why does women’s financial inclusion matter?

Economic growth: If women participated equally, $12 trillion could be added to global annual GDP by 2025. The growth would also be more inclusive.

Benefits to society: Women on average invest 90% of their income back into their families. This leads to not only economic progress but also improves health and education outcomes. When women thrive, so does society.

Large market: Women constitute a large addressable market. There is a strong business case for serving them.

The business case for serving women customers:

There are about 510 million adult women in India. About 77% have Jan Dhan bank accounts . This is a huge market for banks to tap into.

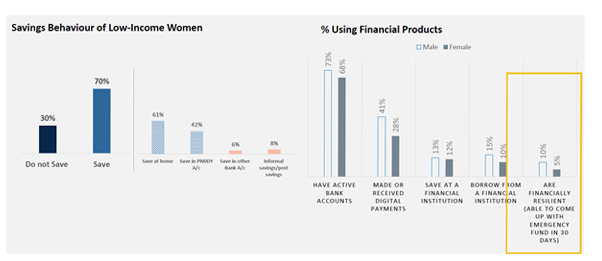

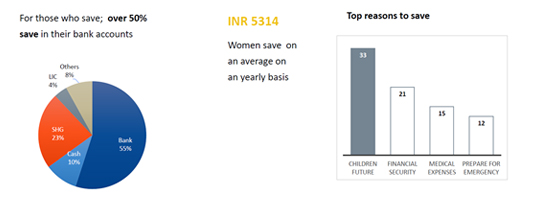

Individually, women have stronger savings behavior than men. Those who can save (60%) prefer liquid and accessible modes specifically for short-term purposes. More than 30% would like to save for children’s futures. But this saving is often done informally, not with a bank.

Women are better borrowers. They are careful about paying back loans and are less likely to default (4% NPA vs 7% for men) and, thus, more profitable (35% margin vs 19% for men) for banks. They have higher customer lifetime value than men. They are more loyal customers. Once women trust a brand, they become its advocates and are more likely to refer products to others; omen may take more time to come onboard, but once enrolled, they more likely to convince other women in groups/ communities to follow in her footsteps.

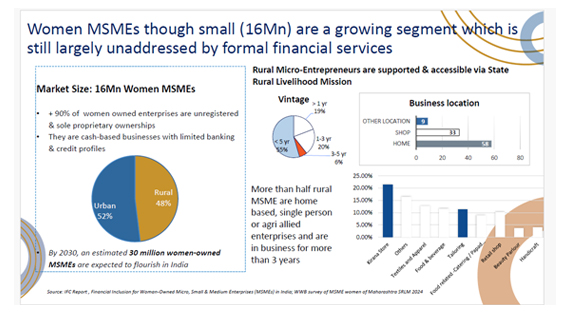

Women MSMEs are a growing segment that is still largely unaddressed by formal financial services. There are some 16 million women MSMEs in India. More than 90% of these enterprises are unregistered and have sole proprietary ownerships. They are cash-based businesses with limited banking and credit profiles. By 2030, an estimated 30 million women-owned MSMEs are expected to flourish in India.

Over the past decade, women-owned enterprises have grown from 14% to 20% of total MSMEs in India. An estimated 70% of the financing demand remains unmet. This translates to a financing gap of Rs 137,000 crore, a huge market opportunity for formal financial institutions.

Why are financial service providers not serving this market?

Women have been traditionally excluded from formal financial services due to patriarchal norms. They are a unique customer base with banking needs different than those of men customers. Consider how women micropreneurs may be undiscoverable to financial services providers because their businesses are remote and lack a digital footprint. Fewer women own properties thus making underwriting difficult for lenders.

Sales channels:

- Women have caregiving responsibilities and restricted mobility which limits their ability to physically visit bank branches. While business correspondents (BC) take banking services to underserved areas, BC Sakhis, operating through SHGs, truly reach the last mile.

- Banking sales channels focus on the main streets, which makes women customers undiscoverable.

- Banks need to actively welcome women customers to financially include them. Recently, Bank of Baroda launched a welcome campaign offering women customers small rewards based on their formal savings. This had a positive impact on women.

- Similarly, Lending Kart introduced a campaign targeted at women small-business owners by guaranteeing bias-free loans and interest rate discounts.

Product features:

Product features must be developed to address the priorities and unique needs of women customers.

- Consider how women have little or no access to smartphones. Even when they do, they may feel hesitant to use digital payments because of under-confidence and mistrust due to thefts, thus feeling discouraged from linking their savings accounts to Unified Digital Payments. In this situation, offering women customers control features, such as through prepaid instruments (PPIs), can gradually build their confidence in transacting digitally without exposing their savings to the larger digital financial ecosystem.

- Fewer women have assets or collaterals, thus making credit underwriting difficult for lenders. Our pilot with Annapurna Finance (NBFC) is tapping into the women’s market by offering them INR 1 lakh collateral-free loans.

Tackling operational challenges

Algorithmic bias in digital financial services refers to systematic errors in AI and machine learning systems that lead to unfair or discriminatory outcomes, particularly affecting marginalized groups like women. In financial services, such biases can result in unequal access to credit, unfavorable loan terms, or exclusion from financial products.

Sources of Algorithmic Bias:

- Data Quality: Algorithms trained on historical data reflecting societal biases may perpetuate those biases. For instance, if past lending data shows fewer loans to women, an algorithm might learn to associate gender with credit risk, disadvantaging female applicants.

- Proxy Variables: Even when sensitive attributes like gender are excluded, other variables (e.g., occupation, marital status) can act as proxies, inadvertently introducing bias.

- Algorithms often factor in mobile phone location and movement patterns, which disadvantage women who primarily operate from home.

- Data Imbalance: About 90% of available data represents men, leaving insufficient data to accurately assess women's financial behavior.

- Impact: This inherent bias in datasets places women at a significant disadvantage in credit assessments.

- Solution: Balance datasets by including more women's data and leverage gender-bias detection toolkits to ensure fairness.

Women centric design

It is important to understand women’s needs and design products and services accordingly. Doing so can lead to an improved business returns while creating growth and prosperity in economies, communities, and families. .

There are four steps to achieving this:

- Segment the customers

- Analyze gender disaggregated data

- Identify opportunities and gaps

- Design differentiated solutions

Designing for women means designing for everyone, as addressing women's needs helps overcome most barriers in financial services. Additionally, women-centric design is an iterative process - we pilot, see what’s working and what’s not, and innovate accordingly.

Q&A

Ms Madhok is a seasoned management consultant. She’s also been at Citibank in retail banking. However, her reluctance stemmed from the fact that traditional banking approaches were not inclusive, leaving behind women and rural populations. With Women’s World Banking, she found her expertise meet gender-inclusive finance, which is critical for global economies to thrive.

The addressable market for UPI among women in India is 200 million. But, penetration is low. Women’s World Banking research project (in collaboration with the National Payments Corporation of India) has identified two key personas:

- The Cautious Balancer represents women who own smartphones but are hesitant to adopt digital payments due to security and control concerns . They prefer cash for its tangibility and control .

- The Fence Sitter represents women who are quite familiar with digital payments but are reluctant to fully embrace the digital financial ecosystem due to inertia and lack of awareness about its wider benefits.

The research identified two primary pathways to nudge these personas toward UPI adoption:

- UPI-Prepaid Payment Instruments (PPIs) as a safe entry point into digital payments for Cautious Balancers. The PPIs provide a sense of control and security by decoupling digital transactions from their savings accounts.

- UPI Merchant Offerings for women-owned micro-businesses. The tangible benefits of UPI for business growth are highlighted transparently and in a gender-sensitive manner through local community influencers to motivate the Fence Sitters to adopt UPI for their enterprise.

Another important step has been to utilize phygital (physical + digital) channels to onboard women customers. This move has been highly effective, particularly when it comes to providing initial handholding, supporting KYC requirements, and delivering technical training. About 90% of Cautious Balancers feel confident transacting digitally when they are on-boarded in person.

Women’s financial inclusion is a global challenge . While India has made significant strides in providing women with access to formal finance (such as through Jan Dhan, Jan Suraksha, and Digital Public Infrastructure), there is an immense opportunity to develop their engagement with financial services and resilience products.

Women’s financial inclusion is the Indian government’s priority. Regulators, policy makers, and banks and financial services providers should prioritize this vision through innovation and intentionality.

Ms Madhok emphasized that ender-disaggregated data is critical to achieving this.

1. Women’s Mobility

- Government Schemes: While free bus tickets are a positive step, ensuring women's safety outside their homes is more critical.

- Private Initiatives: Programs offering loans for two-wheelers and driving lessons can empower women to boost their incomes.

2. Simplifying KYC Processes

- Challenges: Women often struggle with KYC requirements, such as lacking email addresses or reluctance to use video KYC due to privacy concerns.

- Solution: Leveraging local trusted channels for KYC completion can build loyalty, justify costs, and reduce vulnerabilities to digital fraud.

3. Smartphone Usage Among Women

- Current Gap: Men often control smartphones in poorer households, limiting women's access. Even when women have phones, their financial usage is basic, such as opening accounts or availing government schemes.

- Solutions Needed:

- Promote financial literacy and awareness of transactions like investments and insurance.

- Encourage the use of Banking Correspondent channels for biometrics, while addressing mobility barriers.

- Progress: Awareness of insurance has grown in the past decade, but more efforts are needed for women to confidently make claims and explore other financial options.

4. Women as Financial Decision-Makers

- Cultural Barriers: Many women, despite financial skills, are excluded from decision-making, often relying on male family members to manage finances.

- Way Forward:

- Educate male family members to involve women in financial decisions.

- Leverage DBT (Direct Benefit Transfer) to ensure women have active bank accounts, fostering independence.