Finance 2.0: An evening with Ms J Sandhya

On Dec 15, we had an insightful conversation with Ms J Sandhya, Group CFO of Narayana Health. In her session, Ms. Sandhya explored the changing dynamics of finance. She explained the inversion of the traditional pyramid and the transformative impact of Generative AI on Financial Planning & Analysis. While technology is pivotal, challenges often arise due to data and people issues. Ms Sandhya offered deep insights into executing successful digital transformation programs.

About Ms J Sandhya

Ms. Sandhya has a wealth of experience accumulated over close to two decades. Prior to her pivotal role at Narayana Health, she had an illustrious career in the Unilever and Wipro groups. Her diverse roles spanned Business Partnering, Audit and Risk, Ombuds (Ethics Program), Digital Transformation, Controllership, Financial Planning and Analysis, Shared Services, Technology Design and Implementation, Supply Chain Finance, and Project Management.

Ms. Sandhya has been included in prestigious lists such as Asia’s 100 Power Leaders in Finance by Whitepage International, India’s Top 100 Women in Finance by AIWMI, and the FE Power List by Financial Express. Her groundbreaking work has been acknowledged with the title of "Most Innovative CFO" at the Business Leadership Awards 2022. The Institute of Chartered Accountants of India has honored her thrice as the CA CFO /professional achiever of the year.

An alumnus of the ICAI, Ms Sandhya had secured an All India Rank in Foundation, Inter and Final Examination. She is a regular speaker at National and International Conferences of the ICAI and CFO Forums on various topics.

Key trends

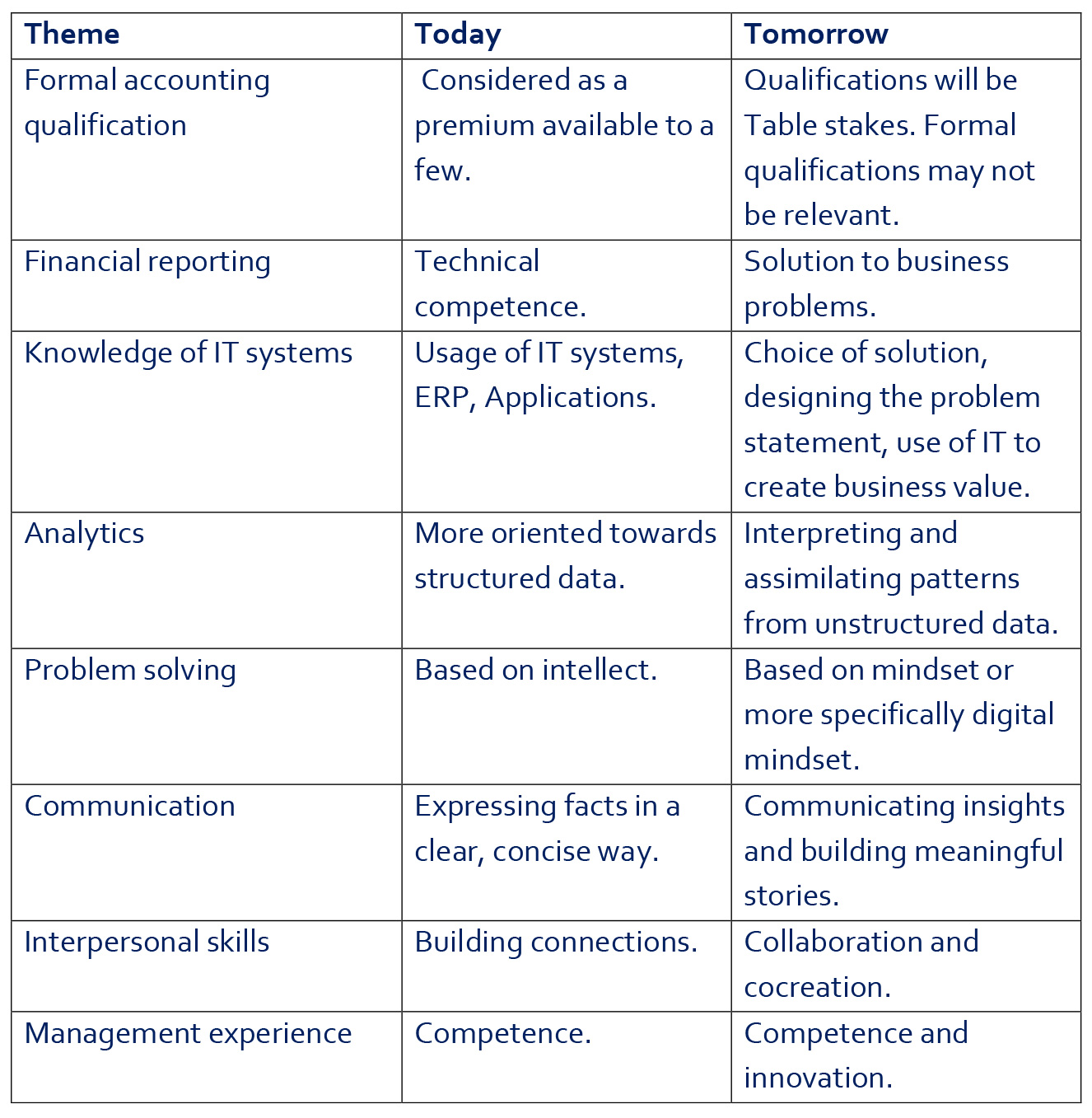

The world of Finance is going through a sea change. Ms Sandhya summarized the key trends as follows.

From Chief controller to Chief Future Officer

From Chief controller to Chief Future Officer

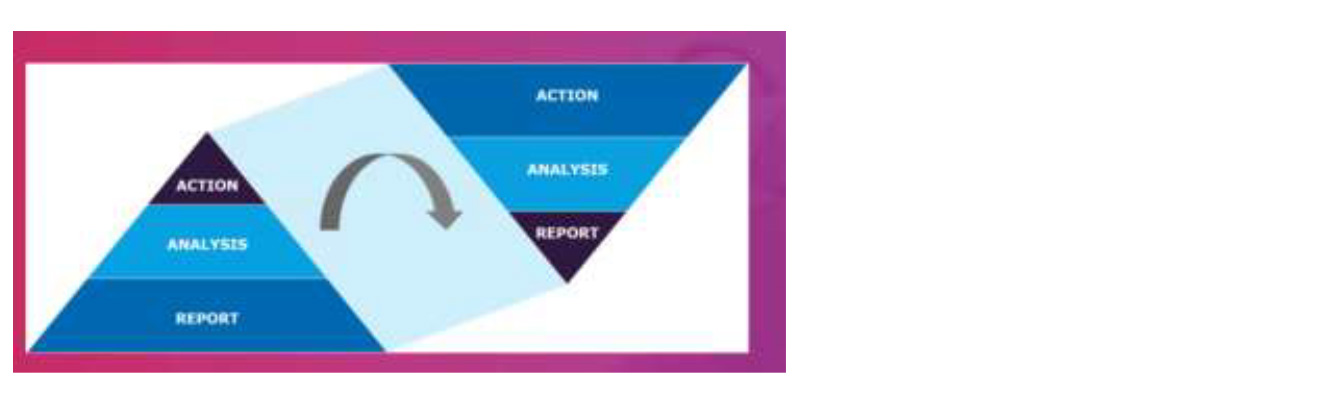

Historically, the role of CFOs has been built on the foundation of reporting, leading to analysis and action. With improved technology and analytics tool, the time spent on reporting will significantly shrink and this time, will be used to improve analysis and drive action.

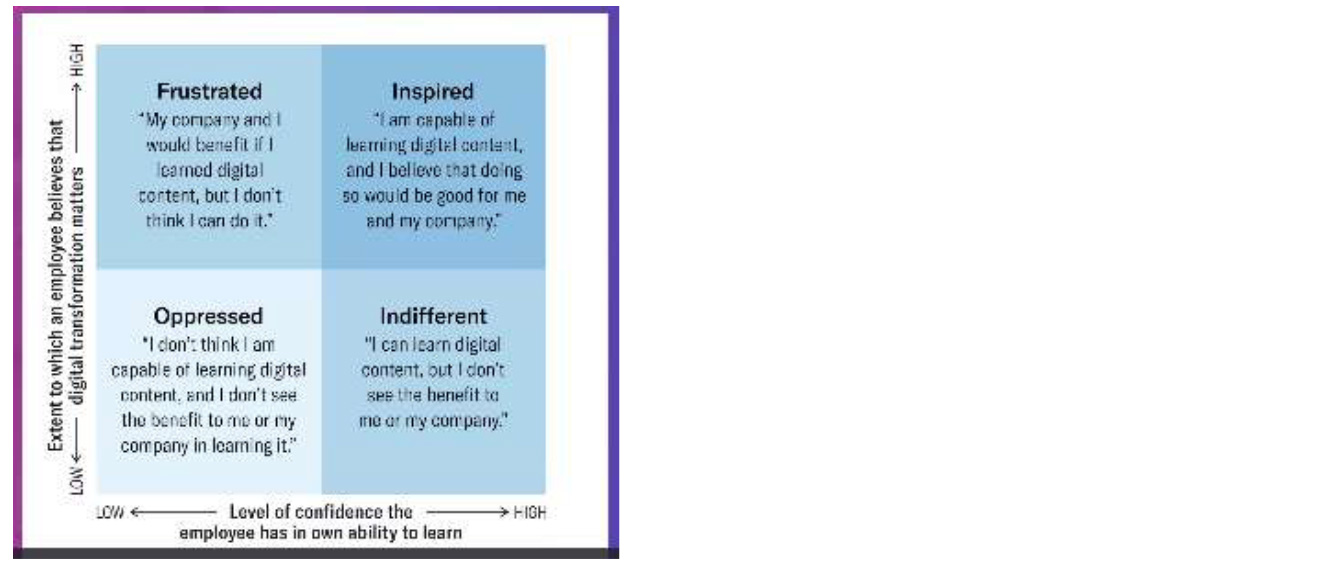

Need for a new mindset

Typically, all people start with a difficulty in adapting to the new content. However, as they start believing that digital transformation matters and start improving their confidence on their ability to learn new tools, they are able to meaningfully add value to themselves and to their organizations.

Q&A

For Ms Sandhya, what matters is what she does in her job and the value she brings to the table. Ms Sandhya has always believed in giving more than 100%. Even when we do our best, we may sometimes succeed and sometimes fail. But what matters is whether we have done our best.

Success is temporary. No one remembers our successes and failures for long. What matters is what we do to ourselves, ie how we develop. As Bobbie Carlyle has mentioned, we are all work in progress. We must try to become better. That sums up Ms Sandhya’s approach to life.

When asked about whether she wants to become a CEO one day, she responded that titles do not matter.. What matters is our ability to create value in our jobs irrespective of what titles we are called.

Note:Self-Made Man (woman) represents the man (woman) who carves himself (herself) and his (her) future from the stone from which he (she) emerges. To carve our future, personality, and spirit, well-grounded values are required.

As McKinsey consultants explain in their book, “Rewired”, most digital transformation initiatives fail on account of two factors: people and data.

Note: Many companies fail in digital transformation. There are no quick fixes. The answer is in rewiring the business so that multiple teams can harness technology to continuously create great customer experiences, lower unit costs, and generate value.

McKinsey Digital's top leaders Eric Lamarre, Kate Smaje and Rodney W. Zemmel explain what it takes in six comprehensive sections – creating the transformation roadmap, building a talent bench, adopting a new operating model, producing a distributed technology environment so teams can innovate, embedding data everywhere, and unlocking user adoption and enterprise scaling.

People must be taken along. They must know why the transformation is happening. The “Why” should be at the center. That will provide the necessary inspiration. The reason for Amazon’s success is its purpose: to be the most customer centric company in the world. Everything starts with the why. If the why is there, the what and how also fall in place.

The second factor is data. There is too much data today. There is more data than we can use. We must learn how to use the data to create business value.

We should become value creators, with the passion and willingness to learn and adapt to business reality.

It is important to set priorities. Not all technologies may be useful. For example, blockchain may not be relevant to all businesses. What some businesses may need is a simple workflow tool or a process change. In any technology solution, there is a secondary process that needs to be fixed. For example, we may attempt warehouse automation with sophisticated IoT tools. But if there is an underlying supply chain bottleneck, say a manual process, the automation will not be effective.

We must act according to the context of the organization. So, we must choose projects which make the biggest impact or create value. The company must have the ability to absorb new technologies. So it is useful to do small pilots that solve important business problems. Then the solution can be scaled up. Each organization must craft its own journey.

Narayana is a good example of how technology can deliver value. Narayana has always been a technology first organization and believed in problem solving using technology. The company did not build a large ERP and then build the analytics layer, as is the common practice. Rather execs identified the top business problems, and then build information systems to solve these problems.

Thanks to this kind of a problem-solving approach, some 160 dashboards are available today at Narayana. At senior leadership level, there is no exchange of spreadsheets. All answers are obtained by querying the BI tool, Medha.

Many tech projects realize only a fraction of the potential benefits. This is because of the focus on technology and not business value. Technology becomes overwhelming and it becomes difficult to reach the promised outcome. A leading IT company had to delay the finalization of its annual report as it could not close its book on time. The reason: implementation of an ambitious technology project. The lesson is that we should not choose a monolithic technology.

It is better to define an outcome and then work backwards and put the technology in place. Building a business case should precede technology implementation.

Business Schools are good at building personalities. They take students who are raw and channelize their capabilities and thoughts. They groom the personalities of these students and build skills such as problem solving, decision making storytelling etc. But B Schools tend to follow a structured curriculum. They need to be more agile. They must also realize that the why and how are as important as the what.

B Schools lay the foundation. They mould the clay. Then the fire is required to toughen it. That is the role of the companies. People must be thrown into difficult situations. They must be enabled to succeed and supported if they fail.

IPOs are driven by valuation. But this valuation should be realistic. Companies must be driven by fundamental valuation principles. Investment decisions must not be driven by greed. Ego prompts execs to keep pumping money and boost valuation. So, valuation sometimes does not reflect the business fundamentals.

Crypto is subject to market risk. Blockchain is a valuable technology and will change the future. CBDCs rest on blockchain. Blockchain will also change digital identity and prevent identity theft. Supply Chain Management can be streamlined with blockchain.

People who use technology will be more successful than those who do not. In the past, people have adapted to technological change. Mostly, blue collar jobs were automated. Today, the impact is on white collar jobs. There will be more pain but we will evolve better at the end of this.

Cash flow is probably the biggest risk. Historically CFOs have been people who flag risks But their roles have evolved today. they need to encourage the right level of risk taking. They must work collaboratively with business to enable prudent choices Then there is the risk of talent. Talent must be upskilled to be ready for tomorrow.

Technology risk is also important. Businesses can be disrupted when technology changes. Consider how Netflix disrupted the movie rental business.

Cybersecurity is emerging as an important risk. Protecting the enterprise in a digital world is not easy. Unlike the past, vulnerabilities exist everywhere. Cybercriminals can take advantage of them.

Data is often available to deal with risk. Some companies use data to their advantage in agile fashion. Others do not.

Kodak was aware of the technology risk and had even developed digital cameras. But execs were uncomfortable with the prospect of eroding the printing business. So, despite having the technology, Kodak did not take the digital camera to the market.

Netflix realized that late fees were putting off customers. So it introduced the subscription model. Existing players had the data, but they could not act upon it. By the time reacted, it was too late.

Innovation cannot be achieved by assembling people in a conference room and telling them to innovate. For innovation to take off, the culture must be shaped and the right behaviors promoted. Formal and informal cues play a big role.

Cash will always be important be it Finance 1.0 or Finance 2.0. The nature of cash may however change from physical to digital forms. As Adi Godrej once said, sales is vanity, profit is sanity and cash is reality.

Earlier CFOs focused on conserving/protecting cash. Today, they must also take risk and generate superior returns. Some amount of leverage is also acceptable. It helps to magnify the returns for shareholders. While doing M&A, we should be careful. The sum of the parts must be greater than the individual components. Otherwise, we will end up overpaying.

Going forward, the key contribution will be bringing our perspectives and point of view to data. As technology becomes pervasive, and AI takes over many routine activities, the instinct will also be equally important. Intuition developed from experiences and mindset coupled with the ability to look at data in the right way will lead to better leadership decision making.

As the role of the CFO expands, is there a danger of the CFO transgressing the limits? Ms Sandhya has never been worried about this. She believes that if we work in the larger interests of the organization and the shared vision, we can build trust. Once we build trust, we will get the space to operate. Once we build trust, we can express ourselves. Of course, we must also be open to feedback and keep learning. We must work within the context of the organization and show progress towards meaningful goals.

We do not have to join a start up to demonstrate our entrepreneurial abilities. In our regular job, we can show our passion and agility and fire in the belly. We can be an intrapreneur in any role. To enable intrapreneurship, there must be a culture of trust and empowerment. People should be allowed to make mistakes and learn from them. A strong vision and purpose can promote togetherness and bonding. When there is greater bonding, people will support each other and there will be more risk taking. People will learn to exercise their freedom within a well-defined framework.

Motivation is easier but inspiration is more difficult. Inspiration needs vision. Inspiration is needed to bind people together and encourage them to go beyond their daily duties. Purpose is important. If every employee can relate to the purpose, they will be inspired.

A very insightful session by Ms J Sandhya. Great moderation by Prof R Prasad and Prof Sudhakar Rao.