An evening with Mr V Nagappan

On Friday, September 20, we had an insightful session by Mr V Nagappan, a highly accomplished leader with a multifaceted career in finance, entrepreneurship, and corporate governance. Mr Nagappan explained how we can bridge the knowledge gap in Indian households and empower individuals with essential financial skills.

About Mr V Nagappan

Mr. V. Nagappan is an MBA (gold medallist) from Annamalai University in 1987. He began his professional journey at Seshasayee Papers & Boards as a management trainee. He later joined the Chemplast Sanmar group, overseeing the sales of PVC resins across Tamil Nadu. Mr Nagappan’s entrepreneurial spirit led him to establish a 100% export-oriented granite monument business. He entered the stock broking industry in 1992 and became a full-time broker two years later.

Mr. Nagappan has held numerous high-profile roles like President of the Hindustan Chamber of Commerce and Chairman of the Federation of Indian Stock Exchanges in 2008. He has also been a member of the Securities and Exchange Board of India’s (SEBI) Secondary Markets Advisory Committee (SMAC), contributing to key regulatory decisions impacting the Indian capital markets. His corporate experience includes directorships at Tamil Nadu Newsprint Limited, Tamil Nadu Power Finance & Infrastructure Development Corporation Ltd., and Tamil Nadu Industrial Development Corporation Ltd.

Mr. Nagappan played a pivotal role in public policy as part of the high-level committee formed by the Tamil Nadu Government to create guidelines for disinvestment of state public sector units. He also chaired the Hindustan Chamber of Commerce’s expert committee on economic affairs, insurance, and banking.

An articulate communicator and thought leader, Mr. Nagappan is a regular columnist in financial dailies and business magazines. He covers topics such as capital market regulations, personal finance, tax planning, commodities, and currency futures. Mr Nagappan has authored six books compiling his extensive writings on these subjects.

Mr. Nagappan is also a visiting faculty member at IIM Trichy, IIT Chennai, and other leading institutions, where he shares his expertise on capital markets and financial regulations. Through his leadership, writings, and educational efforts, Mr. Nagappan remains a prominent figure in India’s financial ecosystem.

Importance of Financial Literacy

Mr Nagappan began by stating that financially independent citizens are critical for a nation’s progress. Financial literacy empowers citizens. It reduces the dependence of citizens on the Government for financial support. As a result, budgetary expenses can come down, resulting in a reduced deficit for the Government.

What is financial literacy? According to Investopedia, “Financial literacy (FinLit) is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing.”

FinLit scores over most of the other skill sets as everyone needs it! It helps to plan, budget, spend wisely, save smartly, invest intelligently and multiply money faster to create wealth asap. In short, FinLit makes a person financially responsible and stand on his own legs with dignity.

Why FinLit now?

We are living in a VUCA world. Gone are the days of permanent, secure jobs. Earlier, if one were diligent and sincere, the job would be safe. But today, hire and fire is the norm. There is a constant need for upskilling and cross skilling. Those who fail to make the cut can lose their job.

Today’s generation spends heavily. A lot of money has come into the hands of people in the rural and semi urban areas. This money is being spent and not saved.

Aspiration for better things has led to lifestyle Inflation. Bottled water, air purifiers and expensive cars are being treated by many people as necessities rather than luxuries.

Inflation has reduced the purchasing power.

With the introduction of GST/PAN/UPI, it is difficult to avoid paying taxes.

Even as expenses are going up, we are seeing moderating returns on Investments as the market matures. At the same time, retail investors are buying complex investment products like derivatives, structured products and REITs without understanding what they are getting into.

The problem of school dropouts

As per the United National Development Program’s (UNDP’s) Global Human Development Index report 2021, the mean years of schooling in India stands at 6.7 years, compared to 7.6 in China and 8.1 in Brazil. India was ranked 132 behind both China (79) and Brazil (87) out of the 191 countries covered in the ranking. Thus, compared to other countries, Indian children are more likely to drop out before completing their school education. This is confirmed by the data. The class 10 dropout rate in 2021-22 was a worrying 20.6 %.

Many of these school dropouts have enough education to pick up semiskilled/ unskilled jobs and start earning. But later in life they end up with financial problems. Some of them are driven to such desperation that they even commit suicide. This can be attributed to lack of financial discipline. In many cases, enough money is not saved. Even if money is saved, it is not invested properly. One of the causes is lack of FinLit.

Compared to subjects like maths which involve IQ, financial literacy needs only basic knowledge and skills: good communication in any language, basic arithmetic: simple / compound interest / EMI, basic smartness, discipline and hard work.

Mr Nagappan gave a pertinent example during the Q&A session. Once Mr Nagappan’s father had given him Rs 5000 to deposit in the bank. After reaching the bank, he found there was only Rs 4900. When he reported this to his father, he accused the young boy of stealing the money. Mr Nagappan could not sleep that night. Only the next day, he came to know that his father had deliberately kept Rs 4900 in the cover. By not counting the money before taking it to the bank, the young boy had not shown the right attitude. In other words, a big part of FinLit is basic discipline.

The FinLit Ecosystem

The government and the regulators must enable education at all levels: School Students, College Students, Teachers, Employees, Employers, Business owners, Home makers, Retired Pensioners.

The key stakeholders are:

Regulators: RBI, SEBI, IRDA, PFRDA

Market Infrastructure Institutions: NSE, BSE, MCX, CDSL, NSDL

Other market participants: Traders, market makers, and investors

The National Centre for Financial Education (NCFE)

NCFE has been set up by all the financial sector regulators as a Section (8) company under Companies Act, 2013 to undertake basic financial education programs and to develop suitable content for increasing financial literacy in the country.

NCFE, in collaboration with regulators and stakeholders, has developed the National Strategy on Financial Education (NSFE) for 2020-25 to enhance financial literacy and promote financial inclusion.

RBI’s financial education initiatives

To promote Financial Inclusion and Education, RBI has created various types of content in 13 languages for banks and other stakeholders to download and use. The aim is to create awareness about financial products and services, good financial practices and consumer protection.

The Financial Literacy Week is an initiative by RBI to promote awareness on key topics every year. Financial Literacy Week 2024 was observed from February 26 to March 01, 2024 on the theme of “Make a Right Start- Become Financially Smart”. The messages disseminated during the week were focused on Saving and Power of Compounding, Banking Essentials for Students and Digital and Cyber Hygiene.

One of RBI’s interesting initiatives is the comic series: Raju and the Money Tree.

https://www.rbi.org.in/FinancialEducation/BasicBanking.aspx

SEBI’s financial education initiatives

https://investor.sebi.gov.in/iematerial.html

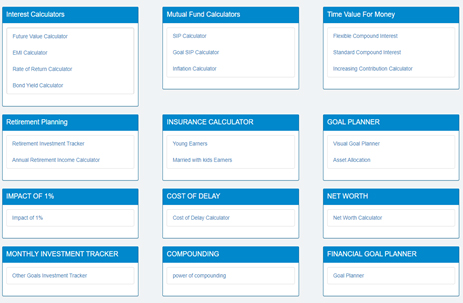

SEBI has various types of useful content on its website. One particularly useful resource is calculators that can enable prudent financial planning:

:: SEBI Investor | Financial Health Check ::

IRDAI’s financial education initiatives

IRDAI has rich resources on various topics including types of insurance policies, filing a claim, customer rights, etc.

The US Federal Reserve’s financial education initiatives

https://www.federalreserveeducation.org/

The US central bank, the Federal Reserve started financial literacy programmes way before the others. There is a rich collection of resources on its website.

Afaltoun: Life Skills and Financial Education for Peace

Gyarapati Adivasi Ashrama School in Korchi taluka of Gadchiroli district is a good example of how financial literacy can be increased at the school level. “Aflatoon Bank” is entirely run and managed by students at the school. The initiative is designed to prepare the students to brace for new financial challenges and train them to take financially sound decisions. Aflatoon bank operates on Monday, Wednesday and Saturday with the students mostly saving their pocket money.

Aflatoun began as an initiative to promote entrepreneurship in corporation schools. Now the initiative has been extended to private schools.

An estimated 230 million children globally live in conflict-affected areas. They need a programme to foster peace and prepare them for community development. The Life Skills and Financial Education for Peace programme, based on the Aflatoun curriculum, aims to empower children as peacebuilders. It encourages children to reject stereotypes and tribalism while promoting financial literacy to combat poverty and unemployment. The aim is to foster critical thinking, analyze conflicts and pave the way for peace and community development in conflict zones and fragile settings.

Challenges ahead

People don’t think of financial literacy as a life skill. They look at it as an optional, extracurricular activity.

We need forms and statements in vernacular in case of financial instruments: Mutual Funds, Insurance, etc. People should not blindly sign on the dotted line without understanding the implications.

We need simple translation into vernacular languages and not transliteration to help people who are not proficient in English! Google Translate sometimes leads to mistakes. Using PhDs in linguistics ensures correctness but the message may not be simple enough to go across to the common man. We need to strike the right balance between simplicity and accuracy. (Discovery of Ombudsman vs Scientific Discovery.) We must train the trainers – and parents, of course!

Q&A

Mr Nagappan did not quite appreciate the importance of financial literacy when he was young. He assumed people had it. Only in his mid-30s, he realized that many people were struggling with their finances and needed help. This prompted him to think of how he could spread financial literacy. Mr Nagappan has authored bestselling books in Tamil to promote financial literacy. He has also been part of over 1000 programs to spread financial awareness.

Some of the content needs more updating. SEBI updates the content regularly. But RBI and IRDA are not doing enough in this regard. In general, the capital markets segment (SEBI and the Market Infrastructure Institutions) is contributing far more to financial literacy than the banking and insurance sectors.

Responding to a question, Mr Nagappan mentioned that there are big opportunities for entrepreneurs to generate content in vernacular (especially in the 5-6 most important vernacular languages), especially in the from of videos and podcasts. (However, YouTube has been misused on occasions. Some influencers are spreading wrong messages.) Mr Nagappan also mentioned that the books he has coauthored with Pugalenthi in Tamil have sold more than 100,000 copies. If they had been written in English, the sales may not have been that good. Mr Nagappan also gave the example of a Tamil Finance magazine that in its heydays had more circulation than Business India, Business World and Outlook Money put together.

Educators, regulators and intermediaries should work together to promote financial literacy and study the impact of the various programs. It is unfortunate that we still see scams like what happened in Assam, where investors were hoodwinked by an unscrupulous fly by night operator (Deepankar Barman) promising high returns.

Delivery is a big challenge. It is the practitioners who are best equipped to deliver the training. But they are not allowed to do so due to conflict of interests.

As parents, we need to change our mindset. We complain about lack of information. But today, everything is available on the internet.

Moreover, we must give more freedom to our children. We do not even allow children to fill in the application forms for college admission. Instead, we fill it up for them. This is an example of how we discourage children from taking any kind of risk.

Compare this with the business communities. From a young age, they are taught the basics of finance at home.

Despite occasional criticism, Mr Nagappan feels that RBI and SEBI are among the better regulators in the country. They listen to the concerns of market participants. SEBI is still considered a trustworthy organization. SEBI’s approach of preparing draft papers for wider public consultation is a best practice.

However, Mr Nagappan felt that the mindset of regulators sh0uld change. Regulators should not be focused only on regulation. They should also take ownership for market development. After all, they have the credibility to enable market development. Greater financial literacy is the starting point for market development.

One participant mentioned that provident funds are being looked down upon by today’s generation. With growing longevity (32-35 at independence and 70 now) and the concept of pensions going away, saving for retirement has a big role to play in ensuring financial security. What can we do in this regard?

Mr Nagappan explained that the GenZ made a lot of money in the stock market during covid. They had limited outlets for spending money. They did not have to worry about EMIs as they do not believe in buying homes. They were not happy with the meagre returns provided by banks. So, they put their surplus money in the stock markets.

The impact of retail investors can be seen from one piece of statistics. It took 20 years (2001-2020) for the country to have 4 crore demat counts. But between 2002 and 2024, 12 crore additional demat accounts were added. It is because of the retail investors that the market has continued to rise despite sales by FIIs.

Mr Nagappan agreed that PPF and EPF are very important avenues for putting money. There is a tax incentive for investment, no tax on interest and no tax at the time of withdrawal. It is important to have a balanced portfolio and not put all the money in equity. Mr Nagappan felt that this will happen over time. Today’s youngsters have confidence in themselves and faith in the markets. But after they go through two business cycles, they will become more mature and grounded.

The formula 100 -age = % of portfolio allocated to equity is well known. Is it still applicable today? Mr Nagappan felt that the formula is generally applicable though there could be exceptions. A relatively young person who has had many financial setbacks may be more inclined to putting money in fixed income instruments. But a much older person who has saved enough may choose to put more money in equity. For example, Mr Nagappan’s father stopped trading when he was 90 and fell ill. On the suggestion of the doctor, after he returned to trading, he became better and continued to trade till 96.

There is a strong case for this. We should do this at the school level. But a mindset change is needed among parents and teachers.

Once when Mr Nagappan organized a financial literacy training program, schools sent mostly the commerce teachers who were already aware of the concepts. If they had sent science teachers, they would have benefited greatly. Some of these schools decided to offer the courses only to Class 11 commerce students. Again, this defeated the purpose. The material was designed for Class 7/8 students. This shows that a mindset change is needed among both parents and teachers.

One participant mentioned that some of the insurance products like ULIPs neither serve the purpose of risk cover nor investment. They are dumped on retired people/ senior citizens.

Mr Nagappan agreed that many banks promote these products without adequate knowledge. Sometimes they deliberately recommend the wrong products to clients. That is because the commissions are good (5% today, compared to 1% for MFs and almost nothing for equity). In contrast, they do not get a commission on deposits. That probably explains why banks are facing a problem in mobilising deposits. Today, credit is growing much faster than deposits.

The IRDA is lenient compared to SEBI. That is probably because India is an underinsured country, and the market needs to be developed. IRDA should do more to prevent mis selling of insurance products.

We must simplify policy documents. Today, they are 20-30 pages long, full of declaimers and written in a language which is difficult to understand. They need to be compressed to one page. The policy documents should also be made available in vernacular language.

There is content. But last mile delivery continues to be a problem. The Government has taken some initiatives, but they are small and limited to some sectors. The Government is also plagued by red tape.

Some CSR initiatives have been launched. Hitachi is a good example.

The challenge exists not only in India but also in other countries.

Impact funds can play a meaningful role in skilling initiatives. Many players go to the government and struggle to raise funding for skilling initiatives. Impact funds operate in a different way. They invest based on outcomes: training, placement and retention. If the expenditure for successful achievement of these outcomes is 100, they are happy to contribute 150. In contrast, the government, which is more concerned with costs and not outcomes, will only be willing to contribute a fraction of 100.