An evening with Mr M R Raghu

On Friday, December 8, we had a fascinating session by Mr M R Raghu, investment banker, big picture observer and economic advisor.

About Mr M R Raghu

Mr M R Raghu is currently CEO of Marmore Mena Intelligence, a subsidiary of Kuwait Financial Center (Markaz), a leading asset management company based in Kuwait with Assets Under Management exceeding $3bn. He is also Economic Advisor to Kuwait Financial Centre, Markaz.

In a career spanning more than 33 years, Mr Raghu has spent nearly 22 years in the Gulf region (Riyadh, Bahrain and Kuwait). Prior to his stint in the Gulf region, he worked with several leading institutions based in India including the Unit Trust of India (UTI) and the engineering consultancy MECON.

Mr Raghu provides regular opinions on global and regional markets, economy, sectors and other businesses through various blogs, columns, and speeches.

Mr Raghu obtained his CFA Charter from the CFA Institute, USA (2003) and the Financial Risk Manager (FRM) certification from the Global Association for Risk Professionals, USA (2005). He is also a Fellow member of The Institute of Cost Accountants of India (1987). Mr Raghu attended a 2-week Investment Management Workshop at Harvard Business School in 2007.

Mr Raghu has been actively associated with the CFA Institute as a volunteer since 2003. He was a founding board member of the CFA Bahrain Society and the founding President of the CFA Kuwait Society. Mr Raghu was also a member of the Education Advisory Committee of the CFA Institute (2012-2019).

In his spare time, Mr Raghu plays Carnatic Flute, enjoys motor biking, plays online chess, watches cricket, and reads non-fiction books.

Global Economic outlook

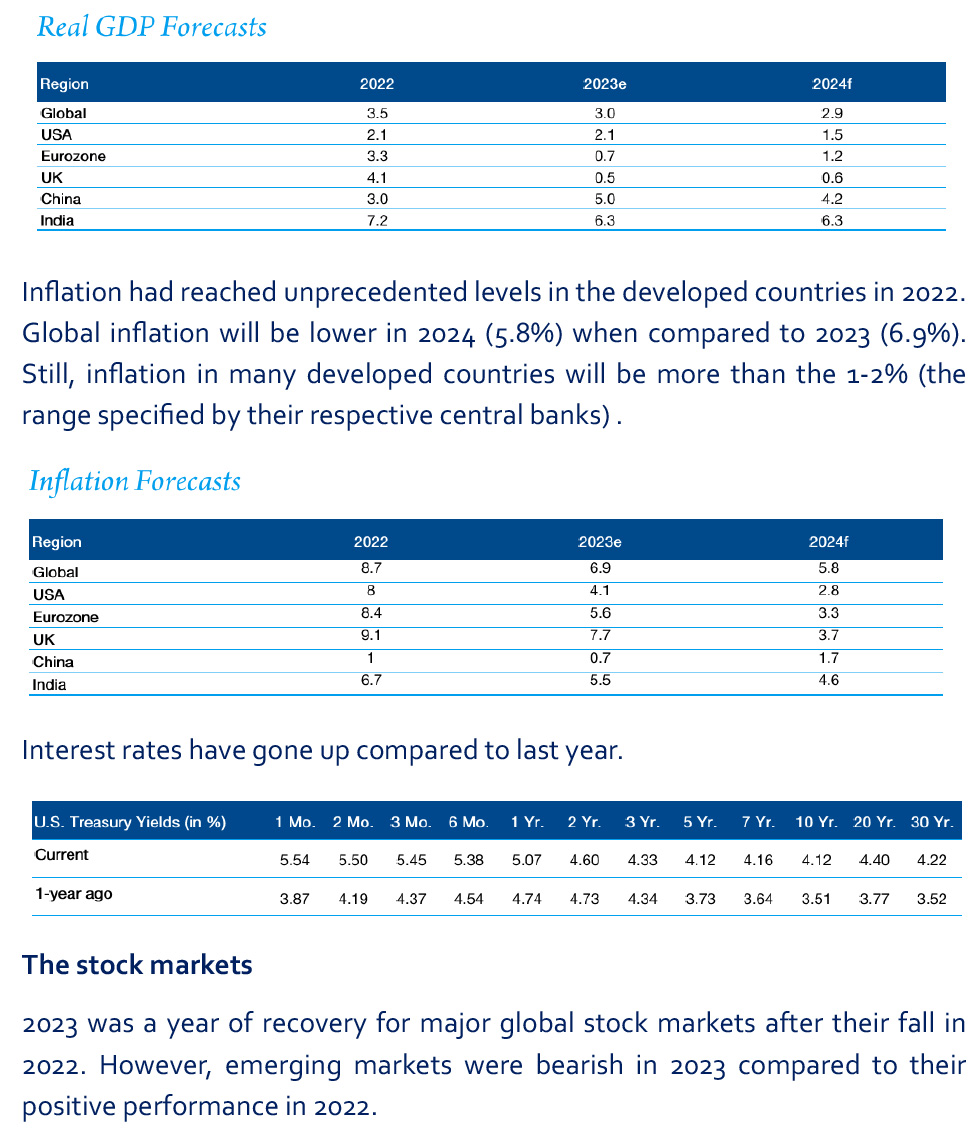

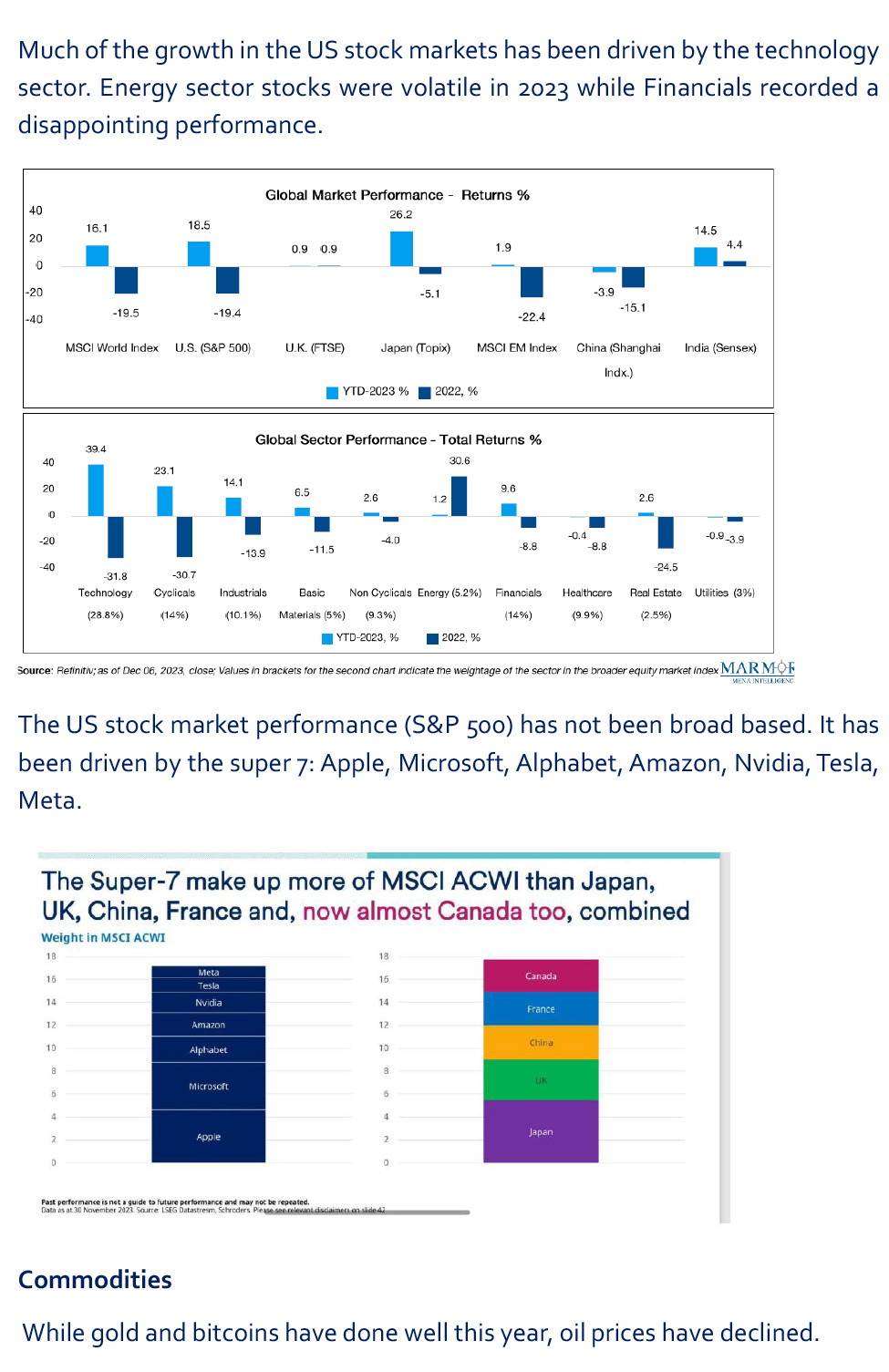

The global economy is likely to slow down in 2024. The US real GDP growth rate is expected to be only 1.5% in 2024. While there are some green shoots emerging in Europe, China will grow at only 4.2%, compared to 5% in 2023. India is the shining star on the horizon with a projected economic growth of 6.3%.

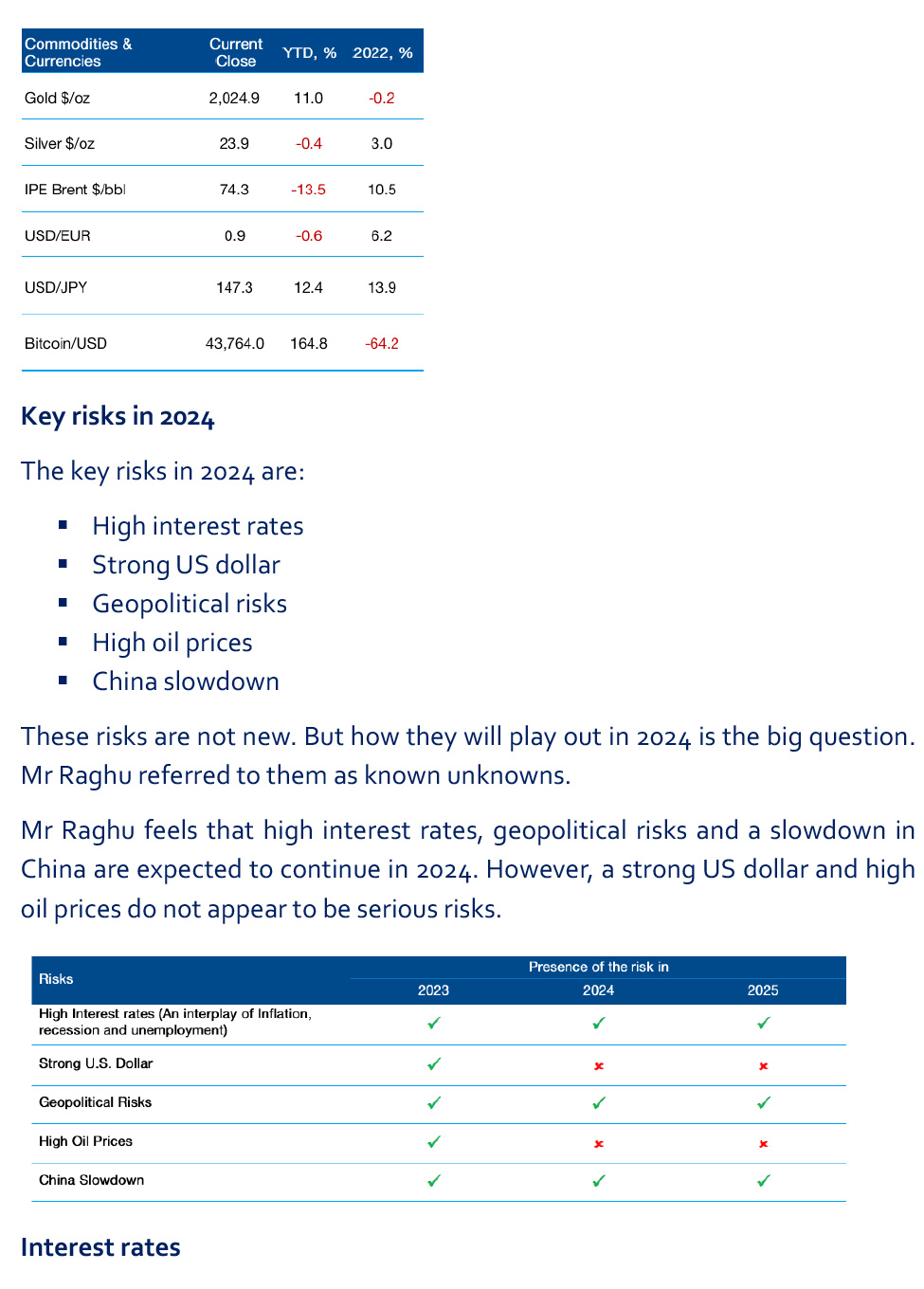

US Dollar

A strong US dollar will diminish the attractiveness of the Indian stock markets. Foreign investors convert their rupee profits, at the end of their investment period, into dollars. If the dollar appreciates, they will get less dollars for the same amount of rupee profits. The dollar has been strong over the last 10 years, except for 2017 and 2020. This strength will continue if the rate cut is postponed by the US Federal Reserve. But we may see a moderate rate cut leading to a weaker USD towards the end of 2024.

Geopolitics

Geopolitics is another important risk to consider. When there is war related disruption, markets react, but they are mostly short-lived. Today we have two conflicts-Russia-Ukraine and Israel Hamas.

When the Russia Ukraine conflict began, the conflict was expected to be over quickly. But that has not been the case. The war is still ongoing. Each side has its own supporters. Russia has the support of China while the USA and NATO are supporting Ukraine.

The conflict has benefited India in the form of cheap oil from Russia. This of course may not continue forever. If the war takes an ugly turn, India may have to shed its neutrality. But this is unlikely. There is a good probability that India will enjoy the supply of cheap oil for a long time to come. Meanwhile, India does enjoy good relations with countries like UAE and Saudi Arabia. Even in the case of disruption in oil supplies from Russia, India can revert to the traditional supplies who have oil in surplus.

The Israel Hamas war has not had much impact on oil prices. But if the conflict spreads to other regions, oil prices may go up.

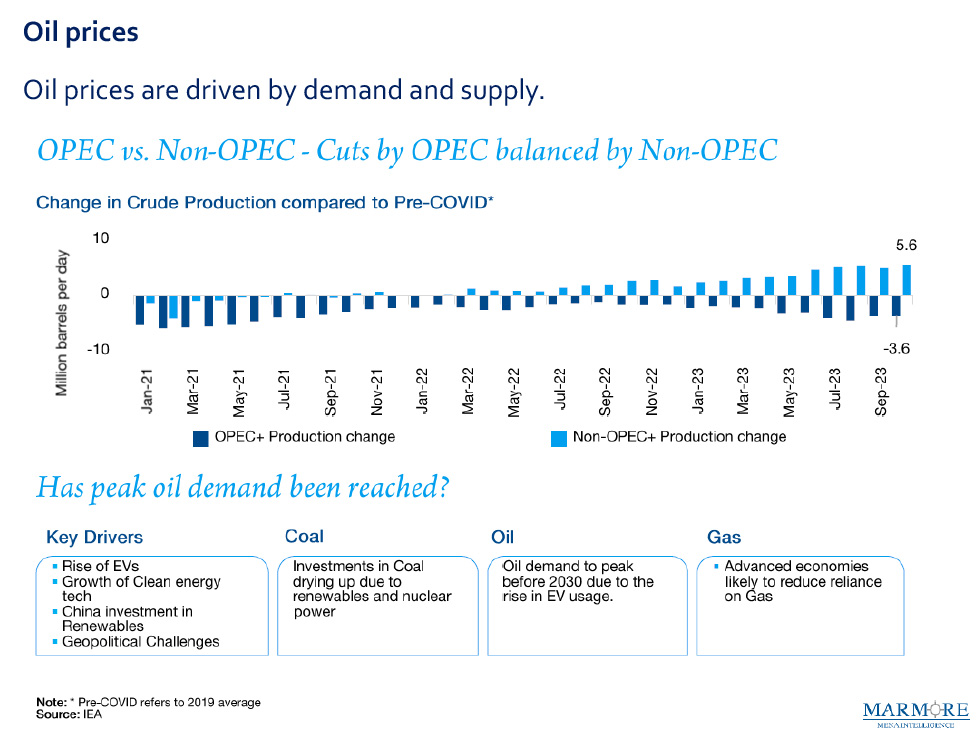

Consider the supply side. While OPEC has pulled out 3.6 million barrels per day from the market, the non-OPEC countries led by the US have pumped in 5.6 million barrels.

Demand for oil will decline because of the transition to clean energy. But this will take time. The world still depends on coal, oil, and natural gas. However, the intensity of oil usage has come down progressively over the years.

China

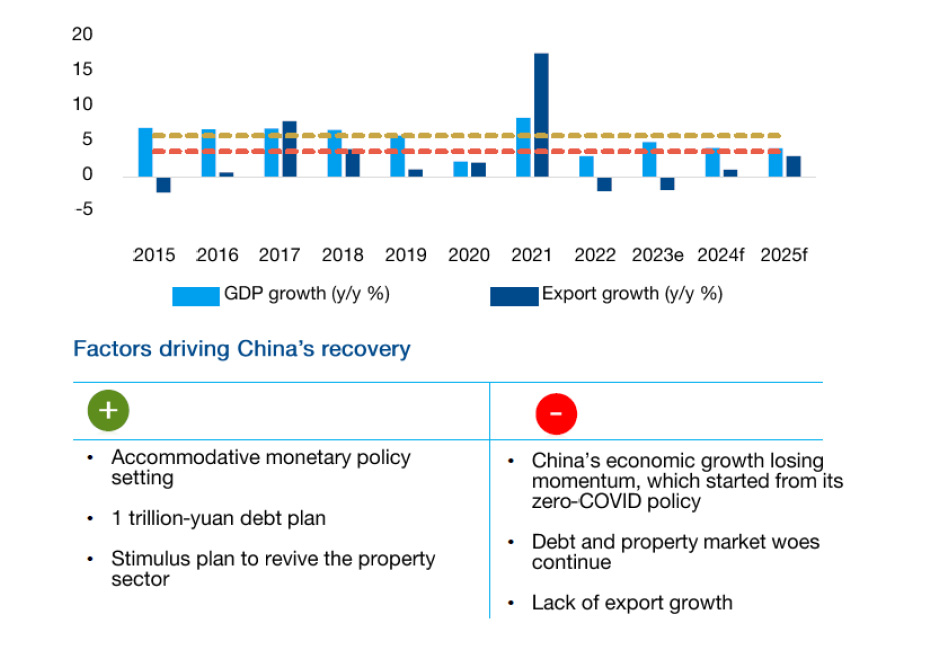

China’s growth has traditionally been driven by exports. China has got into a tangle in recent times because of harsh lockdowns during the pandemic, a crash in the property sector and rising debt. China’s historical economic growth rate used to average at around 10% and the current growth rate is close to 4%.

India outlook

It is difficult to talk of India without a comparison with China.

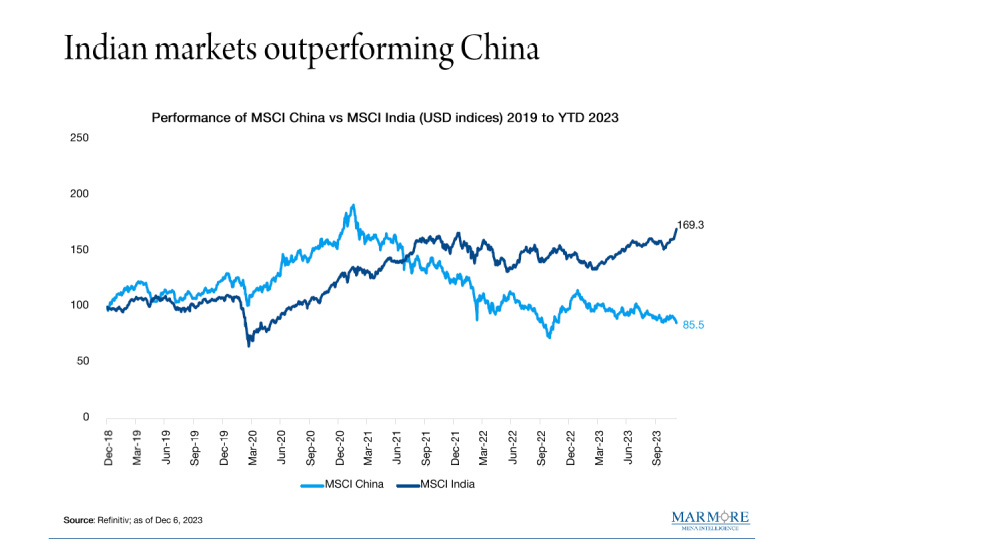

Between 2018 and 2021, MSCI China fared better than MSCI India. But since 2021, India has done much better. $ 100 invested in India in 2018 would have yielded $169.3 by 2023 while in case of China, investors would have received only $ 85.5.

India’s GDP growth seems to be peaking and is likely to remain close to 6% over the next two years. This is due to the fall in fiscal impetus, and weakness in global economies.

India’s external position remains comfortable if we consider the forex reserves and the current account deficit.

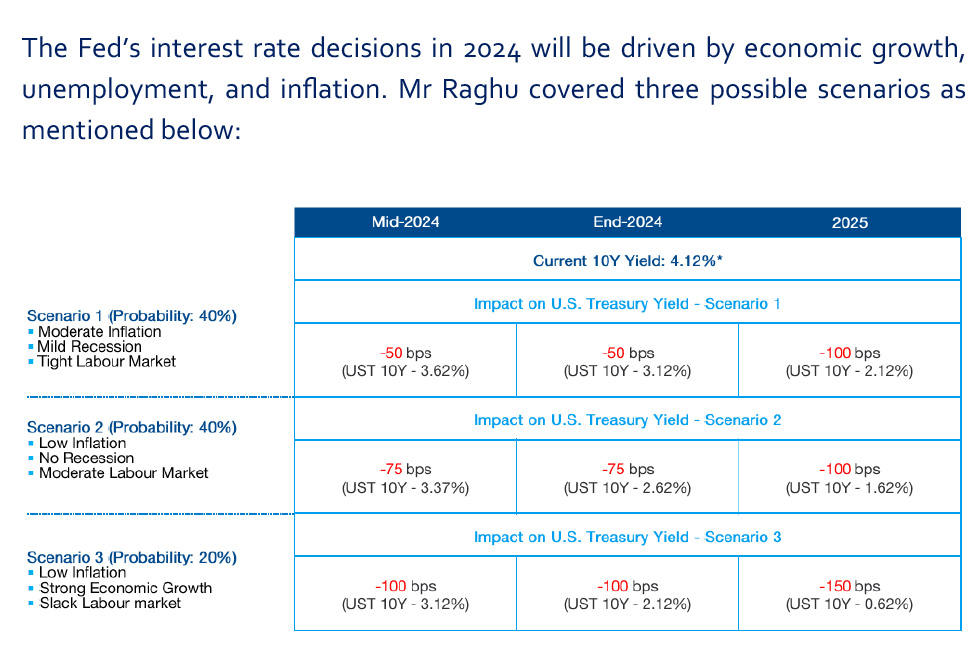

We must also appreciate that India’s prospects are linked to how the US economy shapes up. To combat the pandemic, the U.S. government increased spending to unprecedented levels leading to wider fiscal deficits (from sub 3% to 8-10%). There was a significant expansion of the U.S. Fed balance sheet from $1 trillion to $2 trillion and an easy monetary policy stance for 2.5 years. The resultant impact of easy fiscal and monetary policies over the last 3-5 years led to strong growth and an inflation spiral. In the last 12 months, the US Federal Reserve has hiked interest rates to the tune of 500 basis points (5%) and shrunk its balance sheet from $3 trillion to $1 trillion. The RBI also raised interest rates. Going forward, unless we see a large depreciation on the rupee or higher outflows, Mr Raghu feels the RBI may not raise interest rates.

With India Sovereign bonds being included in JP Morgan Global indices, Mr Raghu expects approximately $ 25 billion inflows in next 12-18 months. This would be highly favourable for the bond market.

Multinational companies are exploring the possibility of diversifying their supply chains from China. This is referred to as the China plus 1 strategy, i.e. have one more manufacturing base besides China. This strategy gained momentum after Covid. India is a huge market, with the largest population in the world and can also serve as an export hub. India has the potential to attract MNC investments flowing out of China. However, India faces competition from other countries like Vietnam. Despite a lot of progress over the last decade, India is still a difficult place to do business. There is a lot of bureaucracy and corruption.

A few macroeconomic risks stand out for India. These include rising crude oil prices, China’s recovery and a possibility of China devaluing its own currency to boost exports and attract capital flows.

Looking beyond 2024

Climate change

The recent COP 28 meeting in Dubai, attended by some 190 countries including India has again drawn attention to this important topic. COP (Conference of the Parties) is the main decision-making body of the United Nations Framework Convention on Climate Change (UNFCCC). It includes representatives of all the countries that are signatories (or 'Parties') to the UNFCCC.]

There are three phases to consider: Realization, Policy making and Implementation. We are currently in the realization phase. (We now understand that global temperatures are going up by about 1.5 c. This is leading to erratic weather conditions.) Then we will have the policy making phase and finally the implementation phase. Climate change is a long term factor whose influence will be felt over the coming decade.

One key dilemma is to resolve the tussle between the developed and developing countries. Developed countries polluted the environment in the earlier part of the 20th century (1900-1960) as they embarked on rapid industrialization. Currently, there is a pressure on the developing countries to cooperate in reducing carbon emissions. But, the developing economies are pushing back. They argue that they cannot stop their own growth (implying the consumption of coal, oil, and natural gas) without receiving adequate compensation from the developed countries. Unless this issue is resolved, it may be difficult to make policies on climate change based on global cooperation.

Demographic change

Demographics and the evolution of cohorts is a very important area of investment research. When it comes to age composition, a few countries like Nigeria are very young, some like Japan are old and others like India and China are in the middle. The ageing of society will have implications for social security, healthcare and so on. It will benefit some industries and create problems for others.

Energy transition

This will take time. As already mentioned, the world still depends on coal, oil, and natural gas.

Rising global debt

Debt levels have risen to enormous proportions and are beyond the servicing capability of many nations. The US has led the way. High debt means higher interest costs. This implies less resources for infrastructure and social sector spending. Even the future generations may have to pay the price.

Deglobalization

After the disruption of global supply chains during Covid, the tendency towards self-reliance has increased. Make in India is an example of this trend. If all countries start thinking of making at home, it will have a severe impact on trade.

Cyberthreats

This has become a major risk. Many central banks have faced cyberattacks leading to losses. Cyberattacks can occur at anytime and anywhere in the world

Artificial intelligence

There will be many job losses in traditional industries because of the advent of AI. More new jobs related to artificial intelligence are likely to be created. But job losses and job creation may not synchronise. Some industries will be affected more. For example, the Hospitality sector may see more job losses than Asset Management. Upskilling and reskilling are the need of the hour.

Our education system has major gaps and will need to gear up for the changing times. It is difficult to get the right person for the right job. Most graduates are not industry ready. This is a problem not only for India but indeed for many countries across the world.

During the Q&A, Prof Prasad added that much of the time of Indian higher educational institutions is going into activities such as NAAC accreditation. But the objectives of these accreditation agencies are not fully aligned with the objective of industry readiness and employability. More efforts and investment must go into redesigning the curriculum.

Obesity

This has major implications for healthcare. There will be opportunities for some sectors and threats for others.

Social media addiction

In recent years, the social media has taken the world by storm. Distraction due to social media is common. This has major productivity implications.

Metaverse economy

Like AI, Metaverse will have implications on how we live, work, think, produce, and sell.

Q&A

For an investment banker, every risk can also be viewed as an opportunity. If a potential trend is taken advantage of, it becomes an opportunity. If it is not handled well, it becomes a risk. Interest reduction for example may lead to a loss in income but it can lead to an increase in bond prices. By investing in bonds, profits can be made.

Risks exist across functions. Risk management must be appreciated by all functions, not just Finance. Risks cut across functions. So a siloed approach can be counterproductive. Every function has its own language to describe risks. Ultimately, these risks result in a bottom-line and topline impact. For example, attrition is a major risk for the HR function. High attrition can reduce revenues and increase costs.

All economic forecasts and risk assessments should lead to better business decisions. This implies the need to manage risks proactively. For example, if there are liquidity requirements, funds should be mobilized at a time when it is more opportune. Another key dimension is to examine whether equity or bond or loan makes sense.

Indian NRIs are somewhat different from the Middle East investors when it comes to their investment strategy. The Gulf based investors have a global portfolio. NRIs in contrast typically invest in India be it equity or real estate. They are more familiar with India and depend on their financial advisors based in India.

The Gulf economies are heavily dependent on expats today:

Kuwait: 80% of the population

Qatar: 95% of the population

UAE: 96 % of the population

This makes it difficult to generate good jobs for the locals. At the same time, these countries are trying to diversify away from oil to become knowledge economies. So, their dependence on expats will continue for the foreseeable future.

Elections are to some extent like wars. They create uncertainty. Usually, they have a short-term impact, say between a month before the elections and a month after the elections. If the outcome is on predicted lines, the market goes up. Otherwise, it falls. Ultimately, it is corporate profits which drive the stock markets.

In recent years, Ecommerce has taken off across the world. In the Gulf, the take-off has been not so strong. People in the Gulf, especially the rich like to go to the malls for shopping. India is far ahead of the Middle East. Thanks to the savvy use of smartphones, ecommerce has taken off in India.